(Finance) – Wall Street continues the session at the levels of the eve, after the Fed number one, Jerome Powell, said that direct and strong action must be taken against inflation. More and more hawkish also there European Central Bank which, in line with expectations, raised interest rates by 75 basis points.

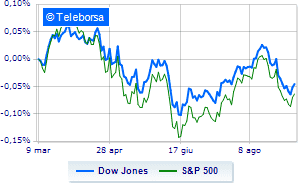

Among the US indices, the Dow Jones reports a variation of -0.06%; on the same line, colorless theS & P-500, which continues the session at 3,976 points, on the eve of the day. Just below parity the Nasdaq 100 (-0.47%); on the same trend, below parity theS&P 100which shows a decline of 0.32%.

Sanitary (+ 1.01%), financial (+ 0.99%) e power (+ 0.62%) in good light on the S&P 500 list. In the list, the sectors telecommunications (-1.01%), informatics (-0.71%) e consumer goods for the office (-0.62%) are among the best sellers.

Among the best Blue Chips of the Dow Jones, JP Morgan (+ 1.64%), Salesforce (+ 1.40%), Goldman Sachs (+ 0.85%) e Verizon Communication (+ 0.66%).

The worst performances, on the other hand, are recorded on Applewhich gets -1.97%.

Honeywell International drops by 1.68%.

Decline for 3Mwhich marks a -1.39%.

Under pressure Walgreens Boots Alliancewith a sharp decline of 1.18%.

Between protagonists of the Nasdaq 100, Regeneron Pharmaceuticals (+ 17.84%), Docusign (+ 2.92%), Constellation Energy (+ 2.86%) e Okta (+ 2.75%).

The strongest sales, on the other hand, show up on Old Dominion Freight Linewhich continues trading at -2.66%.

Collapses Paccarwith a decrease of 2.64%.

Sales hands on NetEasewhich suffers a decrease of 2.61%.

Bad performance for Copartwhich recorded a decline of 2.60%.

Between macroeconomic quantities most important of the US markets:

Thursday 08/09/2022

14:30 USA: Unemployment Claims, Weekly (Expected 240K Units; Previously 228K Units)

17:00 USA: Oil stocks, weekly (expected -250K barrels; prev. -3.33 Mln barrels)

Friday 09/09/2022

4:00 pm USA: Wholesale stocks, monthly (expected 0.8%; previous 1.8%)

Tuesday 13/09/2022

14:30 USA: Consumption prices, monthly (previous 0%)

14:30 USA: Consumption prices, annual (previous 8.5%).