(Finance) – Wall Street continues the session at the levels of the eve and with caution. Investors are all focused on the annual Jackson Hole symposium and await indications on the magnitude of the Fed’s next hikes in the cost of money amid still rising inflation.

The speech of the Fed chairman, Jerome Powell, is scheduled for tomorrow afternoon (at 4 pm Italian time). According to insiders, the governor should confirm the approach taken in the latest statements, namely the need to maintain a restrictive monetary policy, to fight accelerating prices, without causing a recession in the country.

On the macro front, the US GDP figure was below analysts’ estimates and initial requests for unemployment benefits are decreasing.

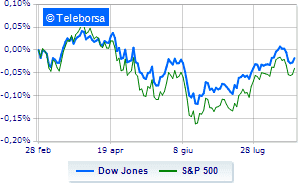

Among the US indices, the Dow Jones shows a variation of + 0.09%, while, on the contrary, theS & P-500 it makes a small jump forward of 0.52%, reaching 4,162 points. Salt on Nasdaq 100 (+ 0.81%); on the same line, with a moderate increase inS&P 100 (+ 0.47%).

Significant upside in the S&P 500 for the sub-funds telecommunications (+ 1.03%), materials (+ 1.01%) e financial (+ 0.95%).

At the top of the ranking of American giants components of the Dow Jones, Intel (+ 2.38%), Boeing (+ 2.32%), JP Morgan (+ 1.71%) e Caterpillar (+ 1.56%).

The strongest falls, on the other hand, occur on Salesforcewhich continues the session with -5.32%.

Disappointing Procter & Gamblewhich lies just below the levels of the eve.

Lazy Merckwhich shows a small decrease of 0.71%.

Between protagonists of the Nasdaq 100, Pinduoduo Inc Spon Each Rep (+ 11.29%), JD.com (+ 9.03%), Baidu (+ 8.44%) e Advanced Micro Devices (+ 4.08%).

The strongest sales, on the other hand, show up on Splunkwhich continues trading at -11.35%.

Negative sitting for Dollar Treewhich falls by 10.21%.

Sensitive losses for Adobe Systemsdown 2.11%.

Negative sitting for O’Reilly Automotivewhich shows a loss of 1.14%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 25/08/2022

14:30 USA: GDP, quarterly (expected -0.8%; previous -1.6%)

14:30 USA: Unemployment Claims, Weekly (Expected 253K Units; Previously 245K Units)

Friday 08/26/2022

14:30 USA: Wholesale stocks, monthly (formerly 1.8%)

14:30 USA: Personal expenses, monthly (expected 0.4%; previous 1.1%)

14:30 USA: Personal income, monthly (expected 0.6%; previous 0.6%).