(Finance) – The Wall Street stock market continues to be mixed after disappointing macro data which showed inflation worse than estimates and GDP falling more than expected. The Fed number one, Jerome Powellsaid the US economy is well positioned to withstand a tightening of monetary policy, but a “soft landing” cannot be guaranteed.

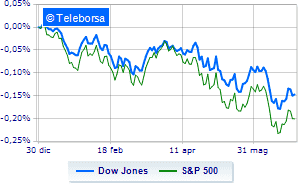

Among the US indices, the Dow Jones is achieving + 0.26%, while, on the contrary, theS & P-500 it has a depressed trend and is trading below the levels of the eve of 3,814 points. Without direction the Nasdaq 100 (-0.06%); on the same trend, almost unchanged theS&P 100 (+ 0.05%).

Significant upside in the S&P 500 for the sub-funds sanitary (+ 0.92%) e consumer goods for the office (+ 0.43%). Among the worst on the list of the S&P 500 basket, the sectors showed the greatest decline power (-2.70%), materials (-1.18%) e industrial goods (-0.93%).

To the top between giants of Wall Street, McDonald’s (+ 1.76%), Goldman Sachs (+ 1.68%), Home Depot (+ 1.54%) e Microsoft (+ 1.40%).

The strongest sales, on the other hand, show up on Caterpillarwhich continues trading at -2.41%.

At a loss American Expresswhich drops by 2.18%.

Heavy Honeywell Internationalwhich marks a drop of as much as -2.08 percentage points.

Sales on Chevronwhich recorded a decline of 1.87%.

Between best performers of the Nasdaq 100, Idexx Laboratories (+ 3.54%), Monster Beverage (+ 2.53%), Astrazeneca (+ 2.00%) e Regeneron Pharmaceuticals (+ 1.76%).

The worst performances, on the other hand, are recorded on Paychexwhich gets -4.55%.

Negative sitting for Advanced Micro Deviceswhich falls by 4.25%.

Sensitive losses for AirBnbdown 4.21%.

Breathless Micron Technologywhich falls by 3.73%.

Between macroeconomic variables most important in the North American markets:

Wednesday 29/06/2022

14:30 USA: GDP, quarterly (expected -1.5%; previous 6.9%)

16:30 USA: Oil stocks, weekly (expected -569K barrels; previous 1.96 million barrels)

Thursday 30/06/2022

14:30 USA: Personal income, monthly (expected 0.5%; previous 0.4%)

14:30 USA: Personal expenses, monthly (expected 0.4%; previous 0.9%)

14:30 USA: Unemployment Claims, weekly (expected 228K units; previous 229K units).