(Finance) – Wall Street continues the session at the levels of the eve, awaiting data on theUS occupation which will be released tomorrow, crucial for the Federal Reserve’s next moves. Useful indications have already come from the data on claims for unemployment benefitsresults on the rise and in line with analysts’ estimates, and from that on American productivitywhich grew beyond forecasts in the second quarter.

Meanwhile, attention remains high on quarterly: expected tonightwith closed markets, the accounts of Apple and Amazon.

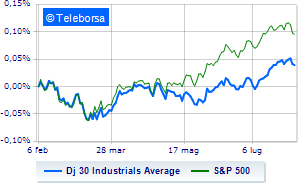

Among US indices, the Dow Jones shows a change of +0.12%; on the same line, colorless theS&P-500, which continues the session at 4,518 points, on the previous day’s levels. In fractional progress the NASDAQ 100 (+0.35%); as well, just above parity theS&P 100 (+0.22%).

In light of the North American S&P 500 the sub-funds power (+1.83%), secondary consumer goods (+0.49%) and telecommunications (+0.48%). At the bottom of the ranking, the biggest declines occur in the sub-funds utilities (-1.68%) and sanitary (-0.41%).

To the top between Wall Street giants, intel (+1.76%), Dow (+1.54%), Nike (+1.34%) and cisco systems (+1.14%).

The worst performances, however, are recorded on Salesforcewhich gets -2.32%.

It moves below parity Caterpillarshowing a decrease of 1.05%.

Moderate contraction for Honeywell Internationalwhich suffers a drop of 0.98%.

Undertone 3M showing a filing of 0.74%.

On the podium of the Nasdaq stocks, MercadoLibre (+11.18%), Constellation Energy (+8.06%), Cognizant Technology Solutions (+7.70%) and Regeneron Pharmaceuticals (+7.02%).

The worst performances, however, are recorded on PayPalwhich gets -10.16%.

Sensitive losses for Qualcommdown 8.56%.

Breathless ANSYSwhich falls by 5.65%.

Under pressure Booking Holdingswhich shows a drop of 2.57%.