(Finance) – The Wall Street Stock Exchange continues stable, with investors’ eyes focused on increasingly hawkish central banks. The US economy created fewer jobs in June than analysts expected, but it hasn’t convinced investors that the Fed’s pause will continue in July.

In an interview released today the ECB President Christine Lagarde he reiterated that the work of monetary policy to bring down inflation is not finished, thus confirming the orientation to further raise rates at the Governing Council meeting at the end of July.

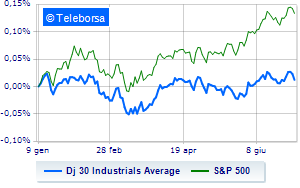

Among US indices, the Dow Jones is substantially stable and stands at 33,986 points, while, on the contrary, theS&P-500 proceeds in small steps, advancing to 4,435 points. Fractional earnings for the NASDAQ 100 (+0.64%); as well as, moderately rising theS&P 100 (+0.41%).

Featured prominently in the S&P 500 are the sub-funds power (+2.41%), materials (+1.73%) and industrial goods (+1.08%). In the lower part of the S&P 500 classification, significant declines are manifested in the sub-funds sanitary (-0.61%) and office consumables (-0.55%).

To the top between Wall Street giants, Caterpillar (+2.81%), 3M (+2.41%), JP Morgan (+1.79%) and Dow (+1.59%).

The worst performances, however, are recorded on Merckwhich gets -2.28%.

Slack Amgenwhich shows a small decrease of 1.47%.

Modest descent for Wal-Martwhich drops a small -1.22%.

Thoughtful Procter & Gamblea fractional decline of 1.15%.

Between best performers of the Nasdaq 100, polish (+5.79%), JD.com (+4.87%), Enphase Energy (+4.32%) and Diamondback Energy (+3.92%).

The strongest sales, on the other hand, show up biogenwhich continues trading at -2.59%.

Under pressure Vertex Pharmaceuticalswhich shows a drop of 1.89%.

He hesitates Gilead Scienceswith a modest drop of 1.47%.

Slow day for Amgenwhich marks a drop of 1.47%.