(Finance) – The US economy created fewer jobs in June than analysts had expected, thus weakening expectations of further hikes by the Federal Reserve.

Job growth was 209,000 versus 306,000 in May, according to the US Bureau Of Labor Statistics. Analyst expectations were for an increase of 240,000 units. There unemployment dropped to 3.6%

In the light of the report on the American labor market and, with its eyes turned to the Federal Reserve, the Wall Street Stock Exchange starts trading cautiously in the last session of the week.

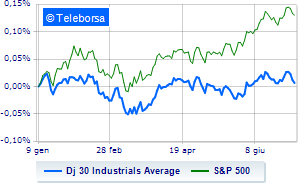

Among US indices, the Dow Jones it settles on the previous day’s values at 33,881 points; along the same lines, a day without infamy and without praise for theS&P-500, which remains at 4,409 points. Without direction the NASDAQ 100 (-0.04%); on the same trend, almost unchanged theS&P 100 (-0.08%).

All sectors slide on the American S&P 500 list. The sector utilitieswith its -0.44%, is the worst in the market.

Only Blue Chip of the Dow Jones in substantial increase is Microsoft (+0.92%).

The worst performances, however, are recorded on Home Depotwhich gets -2.82%.

Colorless 3Mwhich does not record significant changes, compared to the previous session.

Without momentum American Expresswhich trades with -2.3%.

Goldman Sachs is stable, reporting a moderate -2.2%.

To the top between Wall Street tech giantsthey position themselves Keurig Dr Pepper (+1.42%), Charter Communications (+1.12%), Microsoft (+0.92%) and Automated Data Processing (+0.89%).

The strongest sales, on the other hand, show up MercadoLibrewhich continues trading at -7.52%.

Heavy PDD Holdingswhich marks a drop of -5.78 percentage points.

Bad sitting for polishwhich drops by 4.45%.

Sensitive losses for Zoom Video Communicationsdown 4.38%.