(Tiper Stock Exchange) – US markets move higher on hopes of a positive outcome for the talks in Washington to break the deadlock on raising the debt ceiling. US President Joe Biden will continue talks with congressional leaders on the debt ceiling later in the week.

Positive news for US regional banksafter that Western Alliance Bancorp reported growth in deposits to more than $2 billion as Bank of America resumed coverage of the bank with a “Buy” rating.

From the Fed, bostic (Atlanta Fed) said the appropriate policy in its view is to “wait and see how much the economy slows down because of the policy actions taken.” goolsbee (Chicago Fed) instead said it has not yet decided whether to give the green light to a rate break, given that the Fed is monitoring a very large set of data and there are still several weeks to the next meeting.

On the front of quarterly, Targets topped first-quarter profit expectations, but expected lower-than-expected current quarter profit. The data came a day after the weak results of Home Depot and a reading on April retail sales in the United States that fell short of expectations, highlighting the impact of higher prices and interest rates on consumers.

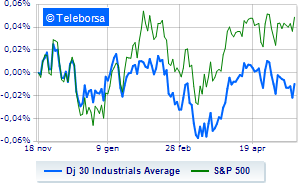

Wall Street continues the session on the rise, with the Dow Jones which advances to 33,411 points; along the same lines, positive performance forS&P-500, which continued the day with an increase of 1.11% compared to the close of the previous session. Up the NASDAQ 100 (+1.03%); on the same line, salt theS&P 100 (+1.05%).

In the S&P 500, the performance of the good compartments financial (+2.16%), power (+2.12%) and secondary consumer goods (+1.89%).

Among the best Blue Chips of the Dow Jones, Home Depot (+4.06%), boeing (+3.17%), Caterpillar (+3.06%) and JP Morgan (+2.90%).

The strongest declines, however, occur on Merckwhich continues the session with -1.66%.

Undertone intel showing a filing of 0.68%.

Under pressure Amgenwhich shows a drop of 0.58%.

Disappointing Procter & Gamblewhich lies just below the levels of the eve.

On the podium of the Nasdaq stocks, Marvell Technology (+4.64%), Applied materials (+3.93%), Tesla Motors (+3.91%) and AirBnb (+3.67%).

The worst performances, however, are recorded on JD.comwhich gets -1.70%.

Slide T-Mobile USwith a clear disadvantage of 1.70%.

Slack Illuminatewhich shows a small decrease of 1.04%.

Modest descent for American Electric Power Companywhich drops a small -1.01%.