(Finance) – Wall Street trades little moosawith investors who await greater clarity on the path to tightening monetary policy Federal Reserve from the Jackson Hole Central Bankers Symposium; Jerome Powell will speak on Friday at 4pm (Italian time). Investors hope that the Fed may be less aggressive than expected following weak US trade activity data.

US private sector companies reported a sharper decline in activity in August, according to the flash estimate onPMI index developed by S&P Global. In addition, they continued to collapse new home sales in the United States in July 2022.

Among the companies that have spread the quarterly: Macy’s revised its guidance downward due to a deterioration in discretionary spending and consumers; Zoom Video Communications cut its annual profit and revenue forecasts; Palo Alto Networks it published optimistic quarterly results and announced a stock split plan; JD.com beat expectations, with lockdowns in China boosting online shopping.

Meanwhile, the oil bounces after the Saudi foreign minister proposed for OPEC + the need to intervene with production cuts. On the contrary, i Gasoline prices in the United States have been declining for 70 consecutive daysthe longest streak since January 2015. Pump prices averaged $ 3,892 per gallon, after hitting a record $ 5,016 per gallon in mid-June, according to data from the American Automobile Association.

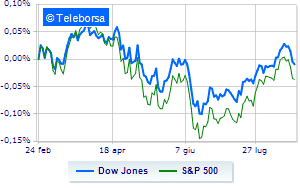

The caution on Wall Street, with the Dow Jones which continues the session with a slight decline of 0.33%, continuing in the bearish wake represented by three consecutive drops, in existence since last Friday, while, on the contrary, theS & P-500, which continues the day at 4,137 points. Slightly positive the Nasdaq 100 (+ 0.23%); on parity theS&P 100 (-0.03%).

They stand out in the S&P 500 i basket sectors power (+ 3.65%), materials (+ 0.77%) e secondary consumer goods (+ 0.64%). Among the worst on the list of the S&P 500, the sectors showed the greatest decline sanitary (-1.49%), utilities (-0.66%) e consumer goods for the office (-0.46%).

Among the best Blue Chips of the Dow Jones, Caterpillar (+ 2.83%), Chevron (+ 2.75%), DOW (+ 1.65%) e Nike (+ 0.84%).

The strongest sales, on the other hand, show up on Procter & Gamblewhich continues trading at -1.92%.

Prey of the sellers Home Depotwith a decrease of 1.75%.

Sales focus on United Healthwhich suffers a decline of 1.48%.

Sales on Merckwhich recorded a decrease of 1.45%.

Between protagonists of the Nasdaq 100, Palo Alto Networks (+ 11.87%), Pinduoduo Inc Spon Each Rep (+ 6.55%), JD.com (+ 4.03%) e Crowdstrike Holdings (+ 3.15%).

The strongest sales, on the other hand, show up on Zoom Video Communicationswhich continues trading at -14.32%.

At a loss Vertex Pharmaceuticalswhich falls by 3.42%.

Heavy Biogenwhich marks a drop of -3.14 percentage points.

Negative sitting for Docusignwhich falls by 2.30%.