(Finance) – A cautious start for the Wall Street stock exchange while the knot of the debt ceiling in the United States remains to be resolved. Meanwhile, investors are wondering about the next moves of central banks in light of the conflicting signals from the economy

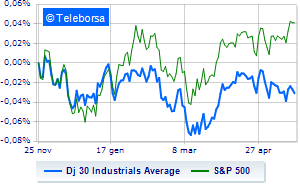

Among US indices, it moves below parity on Dow Jones, which drops to 33,213 points, with a percentage gap of 0.22%; along the same lines, slightly decreasingS&P-500, which continues the day below parity at 4,179 points. Below parity the NASDAQ 100, which shows a decline of 0.38%; as well, slightly negative theS&P 100 (-0.29%).

Appreciable rise in the S&P 500 for the sector power. In the list, the worst performances are those of the sectors materials (-0.85%), sanitary (-0.63%) and telecommunications (-0.60%).

To the top between Wall Street giants, 3M (+2.71%), American Express (+1.67%), intel (+1.17%) and Microsoft (+0.89%).

The worst performances, however, are recorded on Nikewhich gets -3.99%.

Neglected Procter & Gamblewhich remains glued to the previous levels.

Nothing done for McDonald’swhich changes hands on parity.

Colorless Coca Colawhich does not record significant changes, compared to the previous session.

Between best performers of the Nasdaq 100, Atlassian (+7.75%), Lucid Group, (+6.55%), Rivian Automotive (+5.64%) and Tesla Motors (+4.85%).

The worst performances, however, are recorded on Micron Technologywhich gets -2.85%.

The negative performance of O’Reilly Automotivewhich drops by 2.74%.

PepsiCo drops by 2.71%.

Decided decline for Booking Holdingswhich marks a -2.52%.