(Tiper Stock Exchange) – The main Euroland markets are moving in positive territory, on the day when the Federal Reserve will announce its decision on US rates. Market expectations are for an increase of 25 basis points. Attention will mainly be focused on the words of the number one of the central bank, Jerome Powell.

On the currency market, slight growth in theEuro / US Dollar, which rises to 1.09. L’Gold the session continued at the previous levels, reporting a variation of +0.13%. Oil (Light Sweet Crude Oil) continues trading, with an increase of 1.17%, to 79.79 dollars per barrel.

It is reduced by a little spreadswhich reaches +186 basis points, with a slight drop of 2 basis points, while the yield on the 10-year BTP stands at 4.11%.

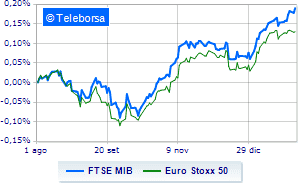

Among the main European Stock Exchanges moderate gain for Frankfurtwhich advanced by 0.22%, nothing done for London, which changes hands on parity; colorless Paris, which does not record significant changes, compared to the previous session. Slight increase for the Milan Stock Exchange, which shows on FTSEMIB an increase of 0.60%; along the same lines, the FTSE Italia All-Share proceeds in small steps, advancing to 28,982 points.

Between best performers of Milan, in evidence BPER (+3.97%), Unipol (+2.79%), Intesa Sanpaolo (+2.16%) and Unicredit (+2.16%).

The worst performances, however, are recorded on Registerwhich gets -1.50%.

Small loss for It is in thewhich trades with -1.32%.

He hesitates DiaSorinwhich drops 0.67%.

Basically weak ENIwhich recorded a decrease of 0.58%.

Between best stocks in the FTSE MidCap, OVS extension (+16.35%), Saras (+4.49%), El.En (+3.22%) and GV extension (+3.18%).

The worst performances, however, are recorded on Cembrewhich gets -1.67%.

It moves below parity Pharmanutrashowing a decrease of 0.51%.

Among the data relevant macroeconomics:

Wednesday 01/02/2023

01:30 Japan: Manufacturing PMI (exp. 48.9 pts; previous 48.9 pts)

02:45 China: Caixin Manufacturing PMI (exp. 49.5 pts; previously 49 pts)

10am European Union: Manufacturing PMI (exp. 48.8 points; previous 47.8 points)

11:00 am European Union: Consumption prices, yearly (expected 9%; previous 9.2%)

11:00 am European Union: Unemployment rate (expected 6.5%; previous 6.6%).