(Finance) – Wall Street improves the trend during the session, eliminating part of the losses recorded at the beginning of the session and showing a volatile trend. Fears about inflation, its effect on corporate earnings and the decisions of the US central bank are always holding the spot. Today the chairman of the Federal Reserve, Jerome Powellshould meet the president Joe Biden at a rare meeting in the Oval Office to discuss inflation.

The meeting comes after Christopher Waller, a member of the Federal Reserve Board of Governors, said yesterday that the US central bank should be ready to raise rates by half a percentage point at each meeting from now on until inflation is curbed.

“Short-term risks appear to be on the downside for growth and riskier assets – wrote analysts from the BlackRock Investment Institute – Central banks speak harshly about inflation, a shock on commodity prices is underway and anti-Covid lockdowns in China have added to a perspective weaker macroeconomic “.

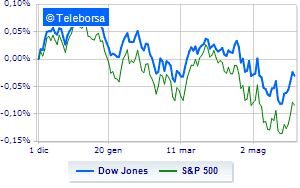

On Wall Street, the Dow Jones it is basically stable and ranks on 33,154 points; on the same line, it moves around parity L’S & P-500, which continues the day at 4,157 points. Slightly positive the Nasdaq 100 (+ 0.32%); as well as, in fractional progress theS&P 100 (+ 0.25%).

Telecommunications (+ 1.18%), power (+ 1.02%) e secondary consumer goods (+ 1.00%) in good light on the S&P 500 list. compartments sanitary (-1.17%), utilities (-1.13%) e materials (-0.93%).

Between protagonists of the Dow Jones, Nike (+ 2.38%), Wal-Mart (+ 0.64%), Chevron (+ 0.63%) e JP Morgan (+ 0.53%).

The strongest sales, on the other hand, show up on Johnson & Johnsonwhich continues trading at -1.39%.

Negative sitting for Cokewhich shows a loss of 1.31%.

Under pressure United Healthwhich shows a decrease of 1.28%.

It slips Home Depotwith a clear disadvantage of 1.22%.

On the podium of the Nasdaq titles, JD.com (+ 6.02%), Pinduoduo Inc Spon Each Rep (+ 5.01%), Dexcom (+ 4.58%) e Lucid (+ 3.76%).

The strongest falls, on the other hand, occur on Illuminatewhich continues the session with -5.60%.

Thud of Constellation Energywhich shows a drop of 4.88%.

Letter on Regeneron Pharmaceuticalswhich records a significant decline of 3.80%.

Goes down Splunkwith a decline of 3.08%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Tuesday 31/05/2022

15:00 USA: S&P Case-Shiller, annual (20% expected; previous 20.3%)

15:00 USA: FHFA house price index, monthly (previous 1.9%)

15:45 USA: PMI Chicago (expected 55 points; preceded 56.4 points)

4:00 pm USA: Consumer confidence, monthly (103.9 points expected; previous 108.6 points)

Wednesday 01/06/2022

15:45 USA: Manufacturing PMI (preceding 59.2 points).