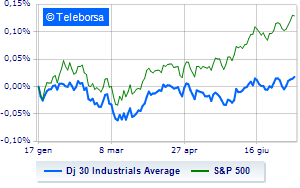

(Tiper Stock Exchange) – The US price list shows a gainafter positive quarterly results of some of the largest banks in the countrywith the Dow Jones which is posting a +0.35%, continuing the bullish trail highlighted by five consecutive gains, triggered last Monday, while, on the contrary, theS&P-500 (New York), which stands at 4,512 points, close to the previous levels. Moderately up the NASDAQ 100 (+0.41%); with similar direction, slightly positive theS&P 100 (+0.28%).

They stand out in the S&P 500 basket i sectors sanitary (+1.59%) and secondary consumer goods (+0.52%). Among the worst of the S&P 500 list, the sub-funds are decreasing the most power (-2.38%), materials (-0.87%) and industrial goods (-0.66%).

As for thestart of the quarterly season, JPMorgan closed the second quarter of 2023 with net income up 67% to $14.47 billion, Wells Fargo with net income up 57% to $4.94 billion, citigroup with net income down 36% to $2.9 billion.

Among other results released before the opening of the market, BlackRock communicated growth in assets under management (AUM) to $9.43 trillion, while UnitedHealth boosted the lower end of full-year earnings guidance.

On the macroeconomic frontimport-export prices decreased in June 2023, according to what was communicated today by the Bureau of Labor Statistics, and American consumer confidence rose in July 2023, according to preliminary data from the University of Michigan.

Between protagonists of the Dow Jones, United Health (+7.73%), Microsoft (+1.81%), Merck (+0.65%) and JP Morgan (+0.51%).

The strongest sales, on the other hand, show up Dow, which continues trading at -2.32%. He suffers cisco systems, which shows a loss of 2.16%. Prey of sellers Chevrons, with a decrease of 1.97%. They focus their sales on Verizon Communicationwhich suffers a drop of 1.60%.

Between protagonists of the Nasdaq 100, Advanced Micro Devices (+3.34%), Nvidia (+2.58%), Copart (+2.38%) and Atlassian (+2.15%).

The strongest sales, on the other hand, show up Modern, which continues trading at -4.54%. Sales on polish, which records a drop of 3.65%. Bad sitting for Warner Bros Discovery, which shows a loss of 3.40%. Under pressure JD.comwhich shows a drop of 2.87%.