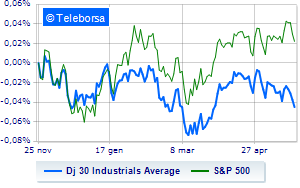

(Finance) – Minus sign for the US stock market, in a session characterized by large sales, while the negotiations to avoid the default of the United States are still stalled, which could take place on June 1st if an agreement is not reached to increase the US debt ceiling.

Among US indices, the Dow Jones shows a drop of 0.71%: theamerican index thus continuing a negative series, which began last Friday, of four consecutive reductions; along the same lines, bad day for theS&P-500, which continues the session at 4,112 points, down 0.81%. Negative the NASDAQ 100 (-0.79%); on the same trend, slightly negative theS&P 100 (-0.65%).

Negative performance in the States on all sub-funds of the S&P 500. Among the worst of the list of the S&P 500, the sub-funds financial (-1.27%), industrial goods (-1.23%) and materials (-1.00%).

Among the best Blue Chips of the Dow Jones, Salesforce (+0.84%) and Merck (+0.53%).

The strongest declines, however, occur on 3Mwhich continues the session with -3.04%.

In red boeingwhich shows a marked decrease of 2.35%.

The negative performance of Walgreens Boots Alliancewhich drops by 2.29%.

intel drops by 2.05%.

On the podium of the Nasdaq stocks, Palo Alto Networks (+7.34%), CrowdStrike Holdings (+2.29%), O’Reilly Automotive (+2.05%) and Netflix (+1.12%).

The worst performances, however, are recorded on analog deviceswhich gets -8.14%.

Thump of Intuitionwhich shows a fall of 7.69%.

Letter about Microchip Technologywhich records a significant drop of 5.80%.

Goes down Modernwith a drop of 5.07%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Wednesday 05/24/2023

4.30pm USA: Oil Inventories, Weekly (exp -920K barrels; prev. 5.04M barrels)

Thursday 05/25/2023

2.30pm USA: GDP, quarterly (exp. 1.1%; previous 2.6%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 250K; Previously 242K)

4:00 pm USA: Home sales in progress, monthly (exp. 0.5%; previous -5.2%)

Friday 05/26/2023

2.30pm USA: Bulk inventory, monthly (previously 0%).