(Finance) – Overwhelming rise for Unicredit which archives the session with a burning climb of 10.79% on the previous values.

The start was effervescent for the title which started today’s session at 8.65 Euros, positioning itself above the top of the previous session and then expanding the performance in the rest of the meeting and ending in a sprint at 9.37, close to the highest value of the sitting.

The stock, already in great shape on the news of the start of the 1.6 billion buyback, has further accelerated its pace in the last half hour of trading, finding assists from press rumors.

According to rumors, in fact, the bank in Piazza Gae Aulenti is in preliminary negotiations to sell its Russian subsidiary after the interest shown by some buyers. But it appears that the sale is one of the options, as it appears that UniCredit is also considering other alternatives for its Russian subsidiary. In any case, the bank’s intention is to enhance the equity investment.

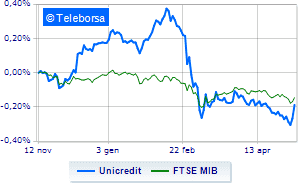

If you compare the performance of the stock with the index FTSE MIBon a weekly basis, thecredit institution maintains positive relative strength with respect to the index, demonstrating greater appreciation by investors compared to the index itself (weekly performance -2.2%, compared to -4.84% of the main index of the Milan Stock Exchange).

Technically, Unicredit it is in a strengthening phase with a resistance area seen at 9.82, while more immediate support is seen at 8.471. At the operational level, the session is expected to continue under the banner of bull with resistance seen at 11.17.

Investors appear quite nervous and highly uncertain about the positions to be taken, given that the sell and buy decisions follow abruptly, bringing intraday volatility to 2.742. Daily trades of 45,175,568 were intense, higher than the one-month moving average of 23,643,145.