(Finance) – Milan is subduedly discounting the coupon detachment of various listed companies, while the other Euroland stock exchanges move with caution, orphaned today by the Wall Street stock exchange which will remain closed for the Juneteenth National Independence Day holiday, which commemorates the liberation of African-American slaves .

Investor focus remains on central banks: Fed Chairman Jerome Powell will testify before Congress on Wednesday. The interventions of some ECB officials are also expected, while the Bank of England is expected to raise rates by 25 basis points on Thursday.

On the foreign exchange market, theEuro / US Dollar the session continued at the previous levels, reporting a variation of -0.15%. L’Gold the session continued just below parity, with a drop of 0.44%. Caution prevailed on the oil market, with oil (Light Sweet Crude Oil) continuing the session with a slight drop of 0.50%.

Salt it spreadssettling at +151 basis points, with an increase of 3 basis points, with the yield on the 10-year BTP equal to 4.01%.

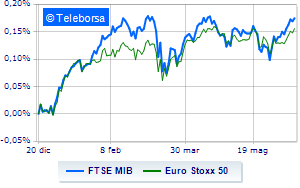

Among the European lists slow day for Frankfurtwhich marks a decline of 0.67%, small loss for London, which trades with -0.51%; he hesitates Paris, which drops 0.53%. The Milanese price list continues the session just below parity, with the FTSEMIB which limits 0.22%; along the same lines, it yields to sales the FTSE Italia All-Sharewhich recedes to 29,929 points.

Among the best Blue Chips of Piazza Affari, excellent performance for BPERwhich records an increase of 2.50%.

Exploits of Unicreditwhich shows an increase of 1.96%.

Money up MPS Bankwhich recorded an increase of 1.88%.

Rev up BPM desk (+1.65%).

The strongest declines, however, occur on Registerwhich continues the session with -1.86%.

Without cues Italgaswhich does not show significant changes in prices.

Basically weak Inwitwhich recorded a decrease of 1.30%.

He suffers Pirelliwhich shows a loss of 1.19%.

Between best stocks in the FTSE MidCap, De Nora Industries (+1.88%), OVS extension (+1.58%), MARR (+1.52%) and Rai Way (+1.44%).

The worst performances, however, are recorded on GV extensionwhich gets -3.31%.

It moves below parity Saphilusshowing a decrease of 2.45%.

Stop Brunello Cucinelliwhich marks an almost nothing done.

Neglected MFE Awhich remains glued to the previous levels.