The market is panicking. Two days after the expiry of the agreement on Ukrainian cereals, the prices of wheat, corn and oilseeds soared on July 19. The price of wheat closed at 253.75 euros per ton on Euronext, gaining 8.2% in just twenty-four hours. Corn, for its part, rose by 5.4% to settle just under the bar of 250 euros per tonne.

These drastic increases come as Moscow refused to renew the agreement on Ukrainian cereals. Signed in July 2022 under the aegis of the United Nations and Turkey, this agreement allowed kyiv to continue to use the Black Sea to export cereals, despite the war. The Kremlin let the text expire on July 17 at midnight. To return to this, he demands the lifting of Western sanctions on his agricultural products and his reintegration into the Swift financial system.

Ukraine: sharp rise in wheat prices

© / afp.com/Olivia BUGAULT

Threats from Moscow

A few hours after this announcement, prices remained stable at first. Ukrainian President Volodymyr Zelensky has said he will continue exports to the Black Sea, and other transport – rail, river and road – has been developed. “But two elements have changed the situation”, explains to L’Express Arthur Portier, consultant Agritel, a consulting firm specializing in agricultural and agro-industrial markets. First, Moscow carried out air attacks on Odessa and Chornomorsk, two of the three Ukrainian ports covered by the agreement. 60,000 tons of cereals were destroyed according to kyiv. Then, Russia warned the international community, assuring that it would consider as a military target any ship heading for Ukrainian ports.

Consequence: many insurers have withdrawn from the area, and prices have soared. “For the moment, we are not yet in the euphoria of last year”, tempers Arthur Portier. The price of wheat reached 250 euros per tonne, far from the peak of 430 euros per tonne in May 2022 before the signing of the agreement. “But the rise is likely to continue in the short term, as these events create new uncertainty in the market,” warns the consultant.

Market uncertainties

Should we therefore fear shortages of cereals, or even episodes of famine? “Everything will depend on the duration of the suspension of the agreement,” said Arthur Portier. Although they are more expensive, other ways of transporting grain exist. Then, Ukraine is not the only supplier: in 2021 it was the third largest exporter of barley, the fourth of corn and the fifth of wheat. The harvests having been good in the northern hemisphere, “it is enough to be able to transport them”, notes the consultant. “If we ran out of wheat, it would be more difficult. There, it just has to be exported.” On the other hand, many countries could find it difficult to withstand a price increase in the long term. Their finances have already been weakened by last year’s sharp rise.

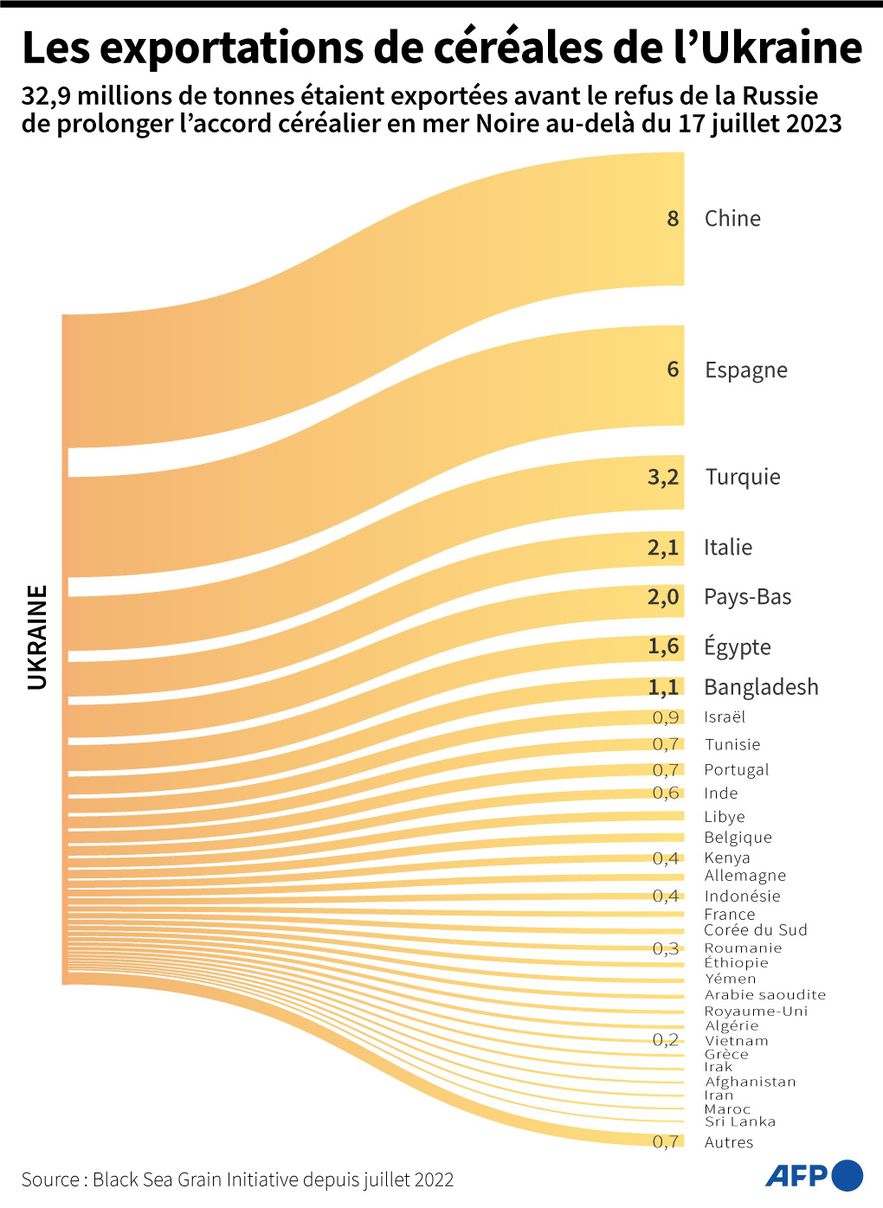

Grain exports from Ukraine

© / afp.com/Jonathan WALTER, Anibal MAIZ CACERES

Since July 2022, the grain deal has seen almost 33 million tonnes of grain flow out of Ukrainian ports. These deliveries mainly benefited China, Spain and Turkey. For his part, Vladimir Putin assured this July 19 that he was ready to return to the agreement if his requests were carried out “in their entirety”. He accused Westerners of using the issue as a tool for “political blackmail”.