(Finance) – It goes back a lot Uber Technologieswhich shows a negative percentage change of 2.30%, despite having improved the outlook on the first quarter in the wake of the strong demand for travel and deliveries.

The private auto transport service provider revised its adjusted EBITDA estimate upward to $ 130-150 million from $ 100-130 million in the previous guidance.

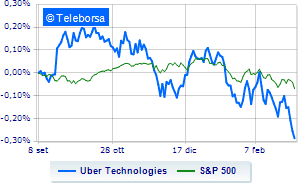

The technical scenario seen at one week of the stock compared to the index S & P-500highlights a slowdown in the trend of Uber Technologies compared toUS basketball indexand this makes the stock a potential target for sale by investors.

The technical framework of Uber Technologies suggests an extension of the bearish line towards the floor at USD 28.07 with the ceiling represented by the area 31.08. The forecasts are for an extension of the negative phase at the test of new lows identified at 26.99.