(Finance) – Cautious departure for the Wall Street stock exchange with investors’ attention turned to the Twitter stock after Elon Musk has put 43 billion dollars on the plate for the social network. A move seen by the market as a prerequisite for a possible operation on the entire share capital of Twitter. The Tesla founder had entered the capital only last week by buying a first 9% and had refused the possibility of joining the board.

Meanwhile, the operators look to the quarterly season that came to life with the accounts of the big banks. After the debut with JPMorgan, under the estimates, it is now the turn of Goldman Sachs, Citigroup, Morgan Stanley and Wells Fargo.

On the macroeconomic side, the number of workers applying for unemployment benefits for the first time in the United States rose more than expected, while on the consumer front, retail sales grew less than expected.

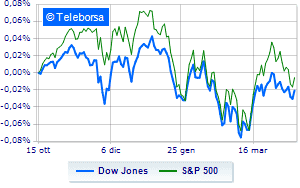

Among the US indices, the Dow Jones shows an increase of 0.51%; on the same line, small step forward for theS & P-500, which reaches 4,459 points. Almost unchanged on Nasdaq 100 (+ 0.09%); fractional earnings forS&P 100 (+ 0.2%).

Significant upside in the S&P 500 for the sub-funds industrial goods (+ 0.75%), materials (+ 0.70%) e consumer goods for the office (+ 0.47%).

Among the best Blue Chips of the Dow Jones, IBM (+ 2.43%), Goldman Sachs (+ 2.34%), Nike (+ 1.66%) e Caterpillar (+ 1.44%).

The strongest sales, on the other hand, show up on Intelwhich continues trading at -0.81%.

Between protagonists of the Nasdaq 100, Marriott International (+ 2.47%), Nvidia (+ 2.24%), Booking Holdings (+ 2.07%) e Walgreens Boots Alliance (+ 1.10%).

The worst performances, on the other hand, are recorded on Synopsyswhich gets -2.82%.

Prey of the sellers NetEasewith a decrease of 1.73%.

Sales focus on Mercadolibrewhich suffers a decline of 1.48%.

Sales on Baiduwhich recorded a decrease of 1.34%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 14/04/2022

14:30 USA: Retail sales, annual (previous 18.2%)

14:30 USA: Retail sales, monthly (expected 0.6%; previous 0.8%)

14:30 USA: Unemployment Claims, Weekly (Expected 171K Units; Previously 167K Units)

14:30 USA: Export prices, monthly (expected 2.2%; previous 3%)

14:30 USA: Import prices, monthly (expected 2.3%; previous 1.6%).