(Finance) – Wall Street continues the session with mixed signs penalized by the disappointing results announced by the tech giants Microsoft and Alphabet (Google), whose stocks are losing more than 7 percentage points. Added to these is the disappointment of Texas Instruments’ fourth quarter guidance.

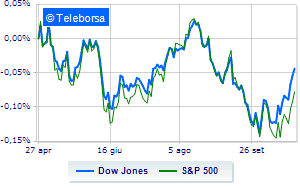

Among the US indices, the Dow Jones shows a fractional gain of 0.37%, continuing the series of four consecutive hikes, which began last Friday, while, by contrast, theS & P-500 it has a depressed trend and is trading below the levels of the eve of 3,850 points. Depressed the Nasdaq 100 (-1.55%); on the same trend, negative theS&P 100 (-0.71%).

Sectors stand out in the S&P 500 basket power (+ 1.87%), sanitary (+ 1.41%) e consumer goods for the office (+ 0.90%). In the list, the worst performances are those of the sectors telecommunications (-3.63%), informatics (-1.57%) e secondary consumer goods (-0.52%).

To the top between giants of Wall Street, Visa (+ 4.41%), 3M (+ 3.10%), IBM (+ 2.07%) e Amgen (+ 1.93%).

The strongest sales, on the other hand, show up on Microsoftwhich continues trading at -6.38%.

Sales hands on Boeingwhich suffers a decrease of 5.25%.

Bad performance for Salesforcewhich recorded a decline of 3.13%.

Sales focus on Applewhich suffers a decrease of 1.35%.

On the podium of the Nasdaq titles, Pinduoduo Inc Spon Each Rep (+ 12.29%), JD.com (+ 10.56%), Baidu (+ 4.53%) e Modern (+ 3.98%).

The worst performances, on the other hand, are recorded on Alphabetwhich gets -7.57%.

Black session for Datadogwhich leaves a loss of 7.54% on the table.

At a loss Alphabetwhich falls by 7.41%.

Heavy Microsoftwhich marks a drop of as much as -6.38 percentage points.

Between macroeconomic variables most important in the North American markets:

Wednesday 26/10/2022

14:30 USA: Wholesale stocks, monthly (expected 1%; previous 1.4%)

4:00 pm USA: Sale of new homes (expected 585K units; previous 677K units)

4:00 pm USA: New homes sales, monthly (expected -13.9%; previous 24.7%)

16:30 USA: Oil inventories, weekly (1.03 million barrels expected; previously -1.73 million barrels)

Thursday 27/10/2022

14:30 USA: GDP, quarterly (expected 2.1%; previous -0.6%).