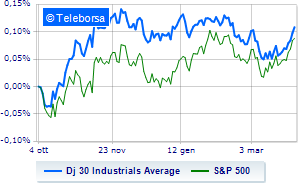

(Finance) – Wall Street continues the session higher, with the Dow Jones which advances to 33,510 points, continuing the positive series that began last Wednesday, while, on the contrary, the colorlessS&P-500, which continues the session at 4,105 points, on the previous day’s levels. In red the NASDAQ 100 (-1.03%); without direction theS&P 100 (-0.1%), after OPEC+’s surprise production cut sent oil prices soaring and renewed inflation fears, further complicating the job for central banks.

Positive result in the S&P 500 basket for sectors power (+4.63%), sanitary (+0.92%) and office consumables (+0.41%). In the lower part of the classification of the S&P 500 basket, significant declines are manifested in the sectors secondary consumer goods (-1.52%), informatics (-0.90%) and utilities (-0.46%).

At the top of the rankings American giants components of the Dow Jones, United Health (+4.38%), Chevrons (+4.25%), Merck (+2.47%) and Walgreens Boots Alliance (+2.41%).

The strongest sales, on the other hand, show up Salesforce,which continues trading at -1.86%.

It moves below parity Nikeshowing a decrease of 1.28%.

Moderate contraction for Microsoftwhich suffers a drop of 1.12%.

Undertone American Express showing a filing of 0.81%.

Between protagonists of the Nasdaq 100, Diamondback Energy (+6.29%), Baker Hughes (+3.47%), Dollar Tree (+2.96%) and Modern (+2.62%).

The strongest declines, however, occur on Tesla Motorswhich continues the session with -6.75%.

Goes down Atlassianwith a drop of 4.32%.

Slide Zscalerwith a clear disadvantage of 3.77%.

In red JD.comwhich shows a marked decrease of 3.49%.

Among the data relevant macroeconomics on US markets:

Monday 03/04/2023

3.45pm USA: Manufacturing PMI (exp. 49.3 points; previous 47.3 points)

4:00 pm USA: ISM Manufacturing (47.5pts expected; previous 47.7pts)

Tuesday 04/04/2023

4:00 pm USA: Industry orders, monthly (exp. -0.5%; previous -1.6%)

Wednesday 05/04/2023

2.15pm USA: Occupied ADP (expected 205K units; previous 242K units)

2.30pm USA: Trade balance (expected -69 Bn $; prev. -68.3 Bn $).