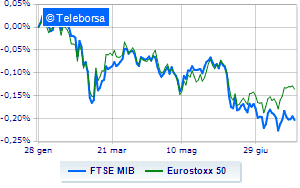

(Finance) – Positive results for the financial markets of the Old Continent. Widespread purchases also affect the FTSE MIBwhich moves on the same bullish wave as the other Eurozone lists, on the day of the Federal Reserve, waiting to understand how aggressive the institute led by Jerome Powell will be on interest rates.

On the currency market, theEuro / US dollar trading continues with a fractional gain of 0.48%. L’Gold shows a timid gain, with a progress of 0.34%. Oil (Light Sweet Crude Oil) rose slightly, advancing to 95.85 dollars per barrel.

Salt it spreadsettling at +245 basis points, with an increase of 9 basis points, with the yield of the ten-year BTP equal to 3.35%.

Among the markets of the Old Continent colorless Frankfurtwhich does not register significant changes compared to the previous session, London advances by 0.54%; moves modestly up Paris, showing an increase of 0.27%. Slight increase for the Milan Stock Exchange, which shows on the FTSE MIB an increase of 0.64%; along the same lines, the FTSE Italia All-Share advances fractionally, reaching 23,360 points.

Top of the ranking of the most important titles of Milan, we find Nexi (+ 7.55%), Unicredit (+ 6.98%), Iveco (+ 3.90%) e Saipem (+ 2.08%).

The strongest falls, on the other hand, occur on DiaSorinwhich continues the session with -1.99%.

It slips Italgaswith a clear disadvantage of 1.93%.

In red Pirelliwhich shows a marked decrease of 1.32%.

The negative performance of Ternawhich falls by 1.25%.

Among the protagonists of the FTSE MidCap, Ariston Holding (+ 3.38%), Buzzi Unicem (+ 3.07%), Danieli (+ 2.89%) e doValue (+ 1.77%).

The worst performances, on the other hand, are recorded on Fincantieriwhich gets -6.38%.

Goes down Mfe Awith a decline of 3.24%.

Collapses Wiitwith a decrease of 2.51%.

Sales hands on SOLwhich suffers a decrease of 2.32%.

Between macroeconomic quantities most important:

Wednesday 27/07/2022

08:45 France: Consumer confidence, monthly (80 points expected; 82 points preceded)

10:00 European Union: M3, annual (expected 5.4%; previous 5.6%)

14:30 USA: Durable goods orders, monthly (expected -0.5%; previously 0.7%)

14:30 USA: Wholesale stocks, monthly (formerly 1.8%)

4:00 pm USA: Sales of houses in progress, monthly (expected -1.5%; previous 0.7%).