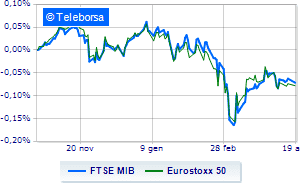

(Finance) – Positive balance for the financial markets of the Old Continent which improve in the mid-morning compared to a more cautious start. Widespread purchases also affect the FTSE MIB where bank stocks are highlighted, in particular Banco BPM currently best performer among the blue chips.

Earnings are still contained the day after warning launched by International Monetary Fund which cut estimates on the growth of the world economy. Investors’ attention always remains high on the war in Ukraine and on the publication of company quarterly reports. We also look at the moves of the central banks: on the agenda tonight the Federal Reserve Beige Book. Disappointment from the People’s Bank of China which today confirmed the one-year LPR rate at 3.7% against analysts’ forecasts of a cut, aimed at supporting the Chinese economy.

On the currency market, slight growth ofEuro / US dollar, which rises to 1,082. L’Gold the session continues just below par, with a drop of 0.36%. Oil (Light Sweet Crude Oil) continues trading, with an increase of 0.81%, to $ 103.4 per barrel.

It comes down spreadsettling at +160 basis points, with a decrease of 3 basis points, while the ten-year BTP reported a yield of 2.47%.

In the European stock market scenario small step forward for Frankfurtwhich shows a progress of 0.32%, compound London, which grew by a modest + 0.28%; modest performance for Paris, which shows a moderate rise of 0.58%. Piazza Affari continues the session with a fractional gain on FTSE MIB 0.43%; along the same lines, the FTSE Italia All-Share proceeds in small steps, advancing to 26,982 points.

Between best Italian stocks large-cap, in the foreground Banco BPMwhich shows a sharp increase of 4.81%.

Take off Pirelliwith an important increase of 2.56%.

In evidence STMicroelectronicswhich shows a strong increase of 2.31%.

It stands out Leonardo which marks an important progress of 2.06%.

The strongest sales, on the other hand, show up on Amplifonwhich continues trading at -1.47%.

Basically weak Inwitwhich recorded a decrease of 0.67%.

It moves below par DiaSorinshowing a decrease of 0.67%.

Moderate contraction for Telecom Italiawhich suffers a decline of 0.62%.

At the top among Italian stocks a mid cap, Intercos (+ 6.45%), Credem (+ 2.24%), Maire Tecnimont (+ 1.66%) e Anima Holding (+ 1.54%).

The strongest falls, on the other hand, occur on Autogrillwhich continues the session with -3.83%.

Goes down MARRwith a decrease of 2.89%.

Prey of the sellers Wiitwith a decrease of 1.81%.

Sales focus on Technogymwhich suffers a decrease of 1.39%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Wednesday 20/04/2022

01:50 Japan: Balance of trade (expected ¥ 100.8bn; previous ¥ -668.3bn)

06:30 Japan: Services index, monthly (previous -0.2%)

08:00 Germany: Production prices, annual (expected 28.2%; previous 25.9%)

08:00 Germany: Production prices, monthly (expected 2.6%; previous 1.4%)

11:00 am European Union: Industrial production, annual (expected 1.5%; previous -1.3%).