(Finance) – The Wall Street financial session is confirmed on the upside with investors optimistic about progress in negotiations in Turkey, between Russia and Ukraine, even if there is still no truce. Both sides spoke of a constructive dialogue, with Russian Moscow opening up to a reduction in military activity to encourage peace talks, while Kiev softened its position on neutrality.

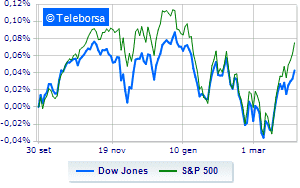

Among the US indices, the Dow Jones marks a fractional gain of 0.29%; on the same line, small step forward for theS & P-500, which reaches 4,598 points. On the rise the Nasdaq 100 (+ 0.84%); with a similar direction, theS&P 100 (+ 0.39%).

In the S&P 500, the sub-funds performed well telecommunications (+ 1.21%), secondary consumer goods (+ 1.17%) e Informatics (+ 0.97%). The sector powerwith its -1.85%, it is the worst of the market.

Between protagonists of the Dow Jones, Nike (+ 2.86%), Visa (+ 2.77%), Walt Disney (+ 2.57%) e Boeing (+ 2.47%).

The strongest sales, on the other hand, show up on Chevronwhich continues trading at -2.51%.

Under pressure Travelers Companywhich shows a decrease of 1.70%.

It slips Caterpillarwith a clear disadvantage of 1.68%.

In red Honeywell Internationalwhich shows a marked fall of 1.09%.

On the podium of the Nasdaq titles, Lucid (+ 7.09%), Zoom Video Communications (+ 6.00%), JD.com (+ 4.99%) e Okta (+ 4.98%).

The strongest sales, on the other hand, show up on Constellation Energywhich continues trading at -1.64%.

The negative performance of Palo Alto Networkswhich falls by 1.48%.

Honeywell International drops by 1.09%.

He hesitates Kraft Heinzwhich yields 0.86%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Tuesday 29/03/2022

15:00 USA: S&P Case-Shiller, annual (expected 18.4%; previous 18.6%)

15:00 USA: FHFA house price index, monthly (previous 1.3%)

4:00 pm USA: Consumer confidence, monthly (107 points expected; previous 105.7 points)

Wednesday 30/03/2022

14:15 USA: ADP employed (expected 438K units; previous 475K units)

14:30 USA: GDP, quarterly (7.1% expected; previous 2.3%).