(Finance) – The Wall Street stock exchange continues positive with investors’ eyes focused on inflation in the United States, scheduled for tomorrow, Thursday 12 January, to understand whether or not there will be a slowdown in rate hikes by the Federal Reserve .

The Fed chairman Jerome Powell he did not provide further indications on monetary policy, speaking the day before at an event in Stockholm, but reiterated that to stabilize prices, difficult and unpopular decisions are also needed from a political point of view.

There is also anticipation forstart of the American quarterlyFriday 13 January, to understand how much the unknown recession could weigh on company profits.

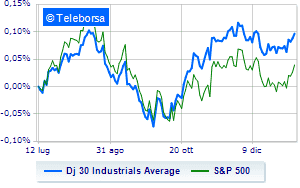

Among US indices, the Dow Jones shows a fractional gain of 0.55%; along the same lines, theS&P-500 the day continues with an increase of 0.85%. Positive the NASDAQ 100 (+1.2%); along the same lines, in cash theS&P 100 (+0.88%).

All sectors slide on the American S&P 500 list.

Between protagonists of the Dow Jones, Microsoft (+2.05%), Home Depot (+1.84%), Goldman Sachs (+1.68%) and Apple (+1.50%).

The strongest declines, however, occur on Verizon Communicationwhich continues the session with -1.88%.

Thoughtful Johnson & Johnsonwith a fractional decline of 1.22%.

He hesitates Procter & Gamblewith a modest drop of 1.16%.

Slow day for Salesforce,which marks a decrease of 1.11%.

Between protagonists of the Nasdaq 100, Lucid Group, (+10.08%), Atlassian (+8.66%), AirBnb (+6.77%) and Amazon (+4.60%).

The strongest declines, however, occur on Intuitive Surgicalwhich continues the session with -5.38%.

Thump of dexcom,which shows a drop of 4.99%.

Letter about Okta,which records a significant drop of 4.74%.

In red Modernwhich shows a marked decrease of 2.52%.

Among the data relevant macroeconomics on US markets:

Wednesday 11/01/2023

4.30pm USA: Oil inventories, weekly (exp -2.24 Mln barrels; prev. 1.69 Mln barrels)

Thursday 12/01/2023

2.30pm USA: Consumption prices, annual (expected 6.5%; previous 7.1%)

2.30pm USA: Consumption prices, monthly (expected 0.1%; previous 0.1%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 220K; Previously 204K)

Friday 01/13/2023

2.30pm USA: Export Prices, Monthly (exp. -0.6%; previous -0.3%).