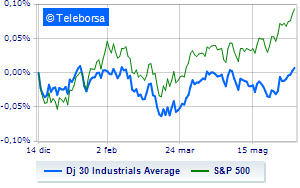

(Finance) – Wall Street continues the session with a fractional gain on the Dow Jones by 0.55%, continuing the bullish trail highlighted by six consecutive gains, triggered last Tuesday; along the same lines, theS&P-500 proceeds in small steps, advancing to 4,368 points. In fractional progress the NASDAQ 100 (+0.64%); on the same trend, just above parity theS&P 100 (+0.54%).

In May, US inflation slowed faster than expected, reinforcing the hypothesis that the central bank will take a pause in monetary tightening. However, prices remain above the Fed’s 2% target. Analysts, while betting that the institution will not announce another rate hike, after ten consecutive hikes, will be attentive to the words of the head of the institute, Jerome Powellto understand future moves and in particular the one at the end of July.

In light of the North American S&P 500 the sub-funds materials (+2.14%), power (+1.24%) and industrial goods (+1.12%).

At the top of the rankings American giants components of the Dow Jones, Caterpillar (+3.22%), Dow (+2.78%), intel (+1.92%) and Chevrons (+1.56%).

The strongest sales, on the other hand, show up Salesforcewhich continues trading at -2.17%.

On the podium of the Nasdaq stocks, Rivian Automotive (+9.29%), Lucid Group, (+4.53%), JD.com (+4.10%) and Align Technology (+3.90%).

The worst performances, however, are recorded on biogenwhich gets -3.15%.

Prey of sellers MercadoLibrewith a decrease of 2.36%.

He hesitates T-Mobile USwhich drops 0.97%.

Basically weak Verisk Analyticswhich recorded a decrease of 0.94%.