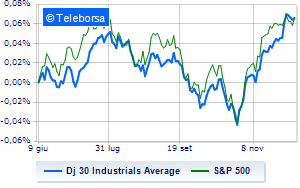

(Finance) – Wall Street continues the session with a fractional gain on Dow Jones by 0.46%; along the same lines, theS&P-500 proceeds in small steps, advancing to 4,607 points.

Slightly positive Nasdaq 100 (+0.43%); on the same line, in fractional progress theS&P 100 (+0.52%).

In the S&P 500, the sectors performed well power (+1.12%), informatics (+0.91%) e financial (+0.65%). At the bottom of the ranking, significant declines are evident in the sector office consumableswhich reports a decline of -0.52%.

At the top of the rankings American giants components of the Dow Jones, Boeing (+2.73%), Goldman Sachs (+2.17%), Walgreens Boots Alliance (+1.88%) e Intel (+1.52%).

The steepest declines, however, occur at Honeywell Internationalwhich continues the session with -1.63%.

Lame Wal-Martwhich shows a small decrease of 1.13%.

Modest descent for Procter & Gamblewhich drops a small -0.86%.

Thoughtful Verizon Communicationswith a fractional decline of 0.65%.

To the top between Wall Street tech giantsthey position themselves Warner Bros Discovery (+6.04%), Lululemon Athletica (+5.61%), Polished (+5.58%) e Atlassian (+2.89%).

The steepest declines, however, occur at Enphase Energywhich continues the session with -3.81%.

In red Illuminatewhich highlights a sharp decline of 2.79%.

The negative performance of Sirius XM Radiowhich falls by 1.80%.

JD.com drops by 1.63%.

Between macroeconomic quantities most important of the US markets:

Friday 08/12/2023

2.30pm USA: Change in employment (expected 180K units; previously 150K units)

2.30pm USA: Unemployment rate (expected 3.9%; previously 3.9%)

4:00 pm USA: Michigan University Consumer Confidence (expected 62 points; previously 61.3 points)

Tuesday 12/12/2023

2.30pm USA: Consumer prices, monthly (prev. 0%)

2.30pm USA: Consumer prices, annual (previously 3.2%).