(Finance) – Wall Street continues the session up on the day the Fed chairman, Jerome Powellbefore speaking to the Senate, he stressed that the central bank is “totally focused” on getting inflation back to the 2% target. In a report to Congress, the Fed then promised an “unconditional” commitment to restore price stability, which is necessary to sustain a strong labor market. “

Expectations are also rising for the outcome of the Fed’s stress tests on the 34 main US banks that will be known tomorrow.

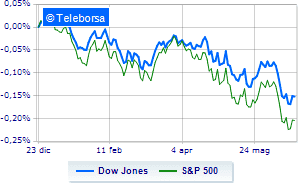

The Dow Jones shows a fractional gain of 0.35%; on the same line, small step forward for theS & P-500, which reaches 3,783 points. In fractional progress the Nasdaq 100 (+ 0.68%); on the same line, just above parity, theS&P 100 (+ 0.54%).

The sectors are in good evidence in the S&P 500 sanitary (+ 1.84%), utilities (+ 1.24%) e telecommunications (+ 1.23%). At the bottom of the ranking, the largest falls are manifested in the sectors power (-3.52%) e materials (-0.84%).

Among the best Blue Chips of the Dow Jones, United Health (+ 2.25%), Johnson & Johnson (+ 2.16%), Merck (+ 1.94%) e McDonald’s (+ 1.92%).

The strongest sales, on the other hand, show up on DOWwhich continues trading at -5.07%.

Goes down Chevronwith a fall of 3.86%.

Collapses Caterpillarwith a decrease of 3.72%.

Sales hands on Nikewhich suffers a decrease of 2.41%.

Between best performers of the Nasdaq 100, Modern (+ 6.19%), Netflix (+ 5.47%), Docusign (+ 5.42%) e Mercadolibre (+ 4.74%).

The strongest falls, on the other hand, occur on JD.comwhich continues the session with -3.63%.

Bad performance for Pinduoduo Inc Spon Each Repwhich recorded a decline of 3.25%.

Black session for Marriott Internationalwhich leaves a loss of 2.53% on the table.

At a loss Ross Storeswhich drops by 2.13%.

Between macroeconomic quantities most important of the US markets:

Thursday 23/06/2022

14:30 USA: Unemployment Claims, Weekly (Expected 225K Units; Previously 229K Units)

14:30 USA: Current items, quarterly (expected $ -273.3 billion; previously $ -217.9 billion)

15:45 USA: PMI services (expected 53.6 points; preceding 53.4 points)

15:45 USA: Composite PMI (preceding 53.6 points)

15:45 USA: Manufacturing PMI (expected 56.4 points; preceding 57 points).