(Finance) – Starting to the upside for the Wall Street stock exchange after the poker of declines scored in this octave. The US list should be able to close today’s session in positive territory supported by the monthly report on US jobs which showed a slowdown in employment growth, albeit at a slower pace than estimated by the market, allowing betting on a less aggressive Federal Reserve on interest rates.

In August, 315,000 jobs were earned over the previous month, while analysts expected an increase of 300,000. Unemployment rose from 3.5% in July to 3.7%, against expectations for a confirmation of 3.5%. An update on industrial orders is also expected for today.

Meanwhile on the oil front, i G7 finance ministers have approved the plan which plans to establish a ceiling on the price of oil which comes from Russia.

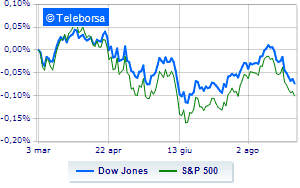

On the first surveys, the Dow Jones shows a fractional gain of 0.40%; on the same line, small step forward for theS & P-500, which reaches 3,991 points. Just above parity the Nasdaq 100 (+ 0.51%); as well as, fractional earnings forS&P 100 (+ 0.56%).

Positive result in the S&P 500 basket for sectors power (+ 1.38%), materials (+ 1.25%) e financial (+ 0.91%).

At the top of the ranking of American giants components of the Dow Jones, Chevron (+ 1.10%), Honeywell International (+ 1.04%), JP Morgan (+ 1.01%) e Apple (+ 0.97%).

Between best performers of the Nasdaq 100, Lululemon Athletica (+ 10.21%), Broadcom (+ 3.04%), Okta (+ 1.72%) e Datadog (+ 1.67%).

The strongest falls, on the other hand, occur on Pinduoduo Inc Spon Each Repwhich continues the session with -3.74%.

Letter on Baiduwhich records a significant decline of 2.69%.

Goes down JD.comwith a decrease of 2.47%.

In red Vertex Pharmaceuticalswhich shows a marked decrease of 1.37%.

Between macroeconomic variables most important in the North American markets:

Friday 02/09/2022

14:30 USA: Unemployment rate (expected 3.5%; previous 3.5%)

14:30 USA: Change in employees (expected 300K units; previous 477K units)

4:00 pm USA: Industry orders, monthly (expected 0.2%; previous 2%)

Thursday 08/09/2022

17:00 USA: Oil stocks, weekly (previous -3.33 Mln barrels)

Friday 09/09/2022

4:00 pm USA: Wholesale stocks, monthly (formerly 1.8%).