(Finance) – Purchases on the Milan stock exchange prevail, in pole position with respect to a positive Europe. Meanwhile, on Wall Street it is just above parity theS & P-500,returned to positive territory after a weak start linked to the American employment data which, although positive, has fueled the risk that the Fed will maintain a more aggressive-than-expected approach to monetary policy

On the currency market, slight growth ofEuro / US dollar, which rises to an altitude of 1.018. Slight increase ingold, which rises to $ 1,743.8 an ounce. Decisive rise in oil (Light Sweet Crude Oil) (+ 1.54%), which reaches 104.3 dollars per barrel.

It comes down spreadsettling at +198 basis points, with a decrease of 5 basis points, while the ten-year BTP reported a yield of 3.28%.

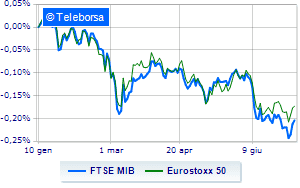

Among the markets of the Old Continent sustained Frankfurtwith a decent gain of 1.34%, without cues London, which does not show significant changes in prices; sitting without momentum for Paris, reflecting a moderate increase of 0.44%. Positive session for the Milanese list, which brings home a gain of 1.00% on the FTSE MIB, continuing the streak that began last Wednesday; along the same lines, the FTSE Italia All-Share it gained 1.07% compared to the previous session, closing at 23,852 points.

From the closing data of the Italian Stock Exchange, it appears that il exchange value in today’s session it amounted to € 1.56 billion, down by 22.61%, compared to € 2.01 billion on the eve of the day; while the volumes traded went from 0.58 billion shares of the previous session to today’s 0.44 billion.

At the top of the ranking of the most important titles of Milan, we find Saipem (+ 7.27%), Leonardo (+ 4.12%), Stellantis (+ 3.83%) e Tenaris (+ 3.68%).

The worst performances, however, were recorded on Italian postwhich closed at -1.56%.

Under pressure Ternawhich shows a drop of 1.50%.

At the top among Italian stocks a mid cap, MPS Bank (+ 11.78%), Saint Lawrence (+ 6.28%), Mfe B (+ 5.91%) e Danieli (+ 5.15%).

The worst performances, however, were recorded on Mutuionlinewhich closed at -2.45%.

It slips Carel Industrieswith a clear disadvantage of 1.70%.

In red BFwhich shows a marked decrease of 1.12%.

Small loss for Saraswhich trades with a -0.92%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Friday 08/07/2022

half past one Japan: Real household expenses, monthly (expected 0.8%; previous 1%)

01:50 Japan: Current items (¥ 186 billion expected; ¥ 501.1 billion before)

08:45 France: Current items (previous – € 3.4 billion)

10:00 Italy: Industrial production, monthly (expected -1.1%; previous 1.4%)

10:00 Italy: Industrial production, annual (4% expected; previous 3.9%).