(Finance) – It ends under the banner of caution the balance sheet in the Old Continent, while the positive performance shown by Piazza Affari stands out, as it is preparing to end 2023 with a strong rise. The session is characterized by a Christmas atmosphere and few ideas, with purchases continuing to be driven by expectations of rate cuts by the Federal Reserve starting from the first months of 2024. The rate was essentially stable.S&P-500 on the American market, which marks a percentage change of +0.06%.

On the currency market, slight increase for theEuro / US Dollar, which shows an increase of 0.66%. Positive session forgold, which is bringing home a gain of 1.08%. Widespread selling on oil (Light Sweet Crude Oil), which continues the day at $74.45 per barrel.

Increase it slightly spreadwhich reaches +159 basis points, with a slight increase of 3 basis points, with the yield on the 10-year BTP equal to 3.49%.

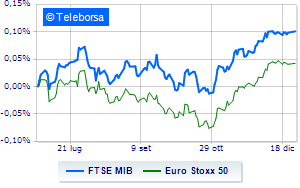

Among the Euroland indices moderately positive day for Frankfurtwhich rises by a fractional +0.21%, session without momentum for Londonwhich reflects a moderate increase of 0.36%, and remains firm Paris, which marks almost nothing accomplished. The Milanese price list shows a timid gain at the end, with the FTSE MIB which achieved +0.22%; along the same lines, the FTSE Italia All-Share it makes a small leap forward of 0.27%, reaching 32,556 points.

On the Milan Stock Exchange it appears that the exchange value in the session of 12/27/2023 it was equal to 1.38 billion euros, from 1.4 billion in the previous session; while the volumes traded went from 0.69 billion shares in the previous session to 0.58 billion.

At the top of the ranking of the most important titles of Milan, we find Saipem (+2.83%), MPS Bank (+1.56%), Fineco (+1.08%) e Iveco (+0.98%).

The strongest sales, however, hit Herawhich ended trading at -0.93%.

Undertone Terna which shows a filing of 0.58%.

At the top of the mid-cap stocks ranking from Milan, Pharmanutra (+3.61%), Carel Industries (+3.50%), Caltagirone SpA (+3.37%) e Digital Value (+3.19%).

The strongest sales, however, hit D’Amicowhich ended trading at -3.83%.

Prey for sellers LU-VE Groupwith a decrease of 2.97%.

Disappointing IRENwhich lies just below the levels of the day before.

Lame El.Enwhich shows a small decrease of 0.91%.