(Finance) – Positive session for the stock markets of the Old Continent, driven by the defensive sectors and by some positive quarterly figures. The most important is that of BHP Billitonthe largest mining company in the world, which experienced a jump in profits thanks to strong commodity prices.

Business Square, returned to trading after the long weekend of August, ended the session just above par. The performance of the utilitieswhile in negative that of Amplifonwhich suffers from the cut in the guidance of the Swiss company Sonova, also active in hearing care. He took profit on TIM And Nexi after the sharp rises on Friday, driven by rumors of extraordinary transactions.

On the macroeconomic front, it continued to decline the German ZEW index in August 2022, signaling a worsening of economic sentiment in the coming months. Unemployed applicants for a subsidy (claimant count) of the United Kingdomwhile the unemployment rate remains at 3.8%. The trade deficit of the Eurozone in June 2022, recording a deficit of 24.6 billion euros.

In the morning they were announced several European M&A deals. Darktrace it is “in the early stages of discussions with Thoma Bravo regarding a possible cash offer for the entire share capital”. Authentic Brands has reached an agreement to acquire Ted Baker for 211 million pounds. Sage Group signed an agreement to acquire Lockstep, without disclosing the financial details of the transaction.

L’Euro / US dollar maintains its position substantially stable at 1.018. Sitting in fractional reduction for thegold, which for now leaves 0.21% on the parterre. The Petroleum (Light Sweet Crude Oil) loses 2.71% and continues to trade at $ 86.99 per barrel.

On the levels of the eve it spreadwhich remained at +217 basis points, with the yield of Ten-year BTP which is positioned at 3.14%.

Among the European lists moves modestly up Frankfurtshowing an increase of 0.68%, positive balance for Londonwhich boasts a progress of 0.36%, and substantially tonic Pariswhich recorded a capital gain of 0.34%.

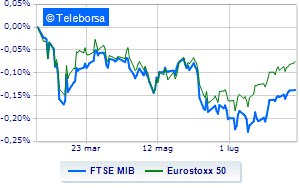

TO Milanthe FTSE MIB is substantially stable, closing the day at 22,998 points, while, on the contrary, a slight increase for the FTSE Italia All-Share, which brings to 25,139 points. On the levels of the eve the FTSE Italia Mid Cap (-0.09%); in red the FTSE Italia Star (-1.13%).

At the close of Milan it appears that the exchange value in today’s session it amounted to € 1.41 billion, an increase of 18.79%, compared to the previous € 1.19 billion; while the volumes traded went from 0.4 billion shares of the previous session to today’s 0.55 billion.

Among the best Blue Chips of Piazza Affari, in high spirits A2A (+ 2.46%).

Shopping hands-on Italgaswhich boasts an increase of 2.37%.

Effervescent Snamwith an improvement of 2.15%.

Glowing Ternawhich boasts a strong increase of 2.07%.

The strongest declines, on the other hand, occurred on Amplifonwhich closed the session at -5.27%.

Black session for Telecom Italiawhich leaves a loss of 3.62% on the table.

At a loss Saipemwhich falls by 2.63%.

Sales on Finecowhich recorded a decline of 1.93%.

Among the protagonists of the FTSE MidCap, Saras (+ 5.32%), Italmobiliare (+ 4.68%), ERG (+ 4.01%) e IREN (+ 2.21%).

The strongest declines, on the other hand, occurred on Replywhich closed the session at -4.95%.

Negative sitting for MPS Bankwhich shows a loss of 2.61%.

Under pressure GVSwhich shows a decline of 1.88%.

It slips Wiitwith a clear disadvantage of 1.67%.

Between macroeconomic variables heavier:

Tuesday 16/08/2022

06:30 Japan: Services index, monthly (expected 0.5%; previous 0.8%)

08:00 United Kingdom: Unemployment rate (expected 3.8%; previous 3.8%)

08:00 United Kingdom: Unemployment benefits claims (expected -32K units; previous -20K units)

11:00 am Germany: ZEW index (expected -53.8 points; previous -53.8 points)

11:00 am European Union: Trade balance (expected – € 20 billion; previously – € 28.4 billion).