(Tiper Stock Exchange) – Weak session for most Asian markets, on a day devoid of macroeconomic data and significant insights. Investors are bracing themselves for a week of crucial data, however, including the index of the consumer prices in the United States which will determine the future path of the Federal Reserve. Operators are also keeping a close eye on the geopolitical developments after the Pentagon shot down a fourth unidentified object in eight days over the United States and Canada.

The Adani groupwhose subsidiaries have lost more than $100 billion in capitalization since January 24, will now aim for a revenue growth 15% to 20% for at least the next financial year, down from the original 40% target, Bloomberg reported, citing people familiar with the matter.

The Securities and Exchange Board of India will meet the finance minister of India Nirmala Sitharaman on February 15, according to Reuters. The board of the Indian market regulator is expected to brief the minister on the “surveillance measures” he took during the collapse of the Adani group’s shares.

This morning, Singapore it said it reported 2022 economic growth at 3.6%, up from 3.8% previously forecast. The city state reiterated its forecast for growth this year of between 0.5% and 2.5%.

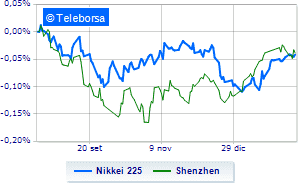

It moves downwards Tokyowith the Nikkei 225 which ends the session with -0.88%, while, on the contrary, a positive performance for Shenzhenwhich continued the day with an increase of 1.12% compared to the close of the previous session, and for Shanghaiwhich scores a +0.75%.

In fractional decline Hong Kong (-0.55%); on the same line, just below parity Seoul (-0.69%). Below parity mumbai, which shows a decline of 0.53%; along the same lines, slightly negative Sydney (-0.22%).

Moderately up the performance of theEuro against the Japanese currency, which trades with a percentage change of 0.67%. Compound rise for theEuro against the Chinese currency, which moves with a gain of 0.24%. The session for theEuro against the Hong Kong dollarwhich trades on the previous day’s values.

The yield ofJapanese 10-year bond trades 0.5%, while the yield for the Chinese 10-year government bond is equal to 2.9%.

Between macroeconomic quantities most important of the Asian markets:

Tuesday 02/14/2023

00:50 Japan: GDP, quarterly (exp. 0.5%; previous -0.2%)

05:30 Japan: Industrial Production, Monthly (exp. -0.1%; previous 0.2%)

Wednesday 02/15/2023

05:30 Japan: Services index, monthly (exp. 0.1%; previous -0.2%)

Thursday 02/16/2023

00:50 Japan: Trade balance (expected -¥3,871.5 billion; prev. -¥1,448.5 billion)

00:50 Japan: Core Machinery Orders, Monthly (Exp. 3%; Previous -8.3%).