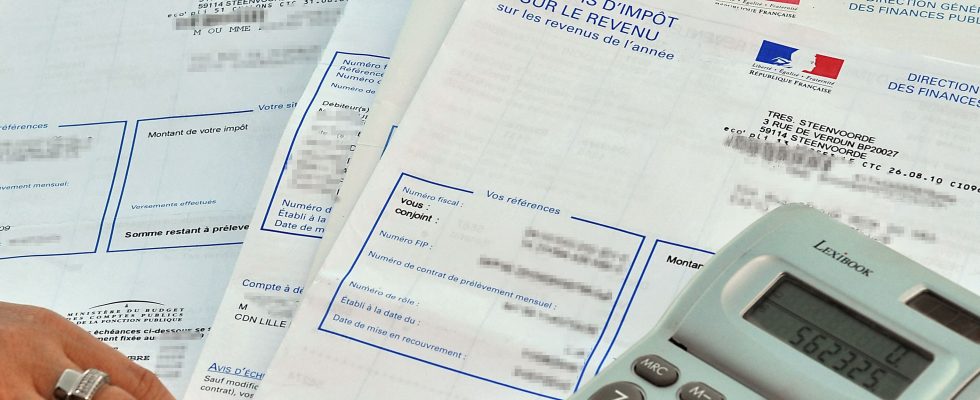

After the Christmas holidays, it’s a nice surprise arriving in your bank account today. This Monday, January 15, the 9 million households having benefited from credits and tax reductions in 2023 will receive their advance, in the form of a transfer from the tax administration.

The Treasury will pay a total amount of 5.8 billion euros. “The payment of the advance of reductions and tax credits aims to support and develop employment at home but also donations or accommodation in nursing homes by anticipating the perception of the associated tax advantage,” explains the ministry. of the Economy in a communicated published Friday January 12.

This system also helps to support the purchasing power of the French people concerned, with an average payment of €634 per beneficiary household. It was 624 euros in 2023.

60% of the total amount of tax reductions and credits

These advances also concern tax advantages relating to union dues, rental investment expenses (Duflot, Pinel, Scellier, DOM, Censi-Bouvard), as well as childcare costs, the ceiling of which has passed the last year from 2,300 to 3,500 euros for children under 6 years old.

In the event that the taxpayer has not benefited from an immediate tax credit, this advance, paid in one go, corresponds to 60% of the total amount of the reductions and tax credits concerned, declared in spring 2023 under of expenses incurred in 2022.

The final amount of tax reductions and credits to which the taxpayer is entitled will be calculated by the tax authorities next spring, following the income tax declaration campaign. This sum will be regularized in the summer of 2024 taking into account the amount of the advance paid in January 2024.

To “fight against fraud relating to the payment of these sums”, Bercy also announces “reinforced controls” of the tax administration. Taxpayers for whom the tax administration does not have bank details (nearly 18,000 tax households) will receive this advance in the form of a check that they will receive by post by the end of January .