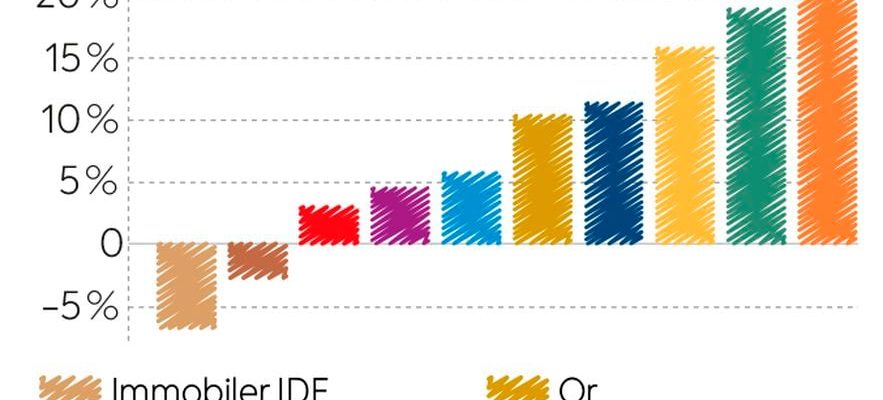

The year 2023 will have defied all predictions. Experts expected a stock collapse? The markets decided otherwise. The flagship index of the Paris Stock Exchange, the CAC 40, thus displays a solid balance sheet with an increase of 16.5% over the period. Better: in the United States, the S&P 500 has gained more than 24% in twelve months and the Nasdaq – the index of technology stocks – more than 43%! The reasons for this insolent health? First of all, good resilience of companies in a difficult economic environment. But also a lot of hope on the part of investors in the developments of artificial intelligence and in a probable easing of monetary policy. Optimism which largely supported prices at the end of the year. Note, however, that “this performance hides enormous disparities between values, as underlined by Nadine Trémollières, director of Primonial Portfolio Solutions. Within the American index, the seven stocks Apple, Amazon, Microsoft, Alphabet, Meta, Tesla and Nvidia, called the Magnificent 7, represented almost 80% of the overall performance.”

NEW3789CT Good performance on stocks

© / The Express

The world of rates was less surprising. With six key rate increases during the year, the European Central Bank has shown the way. As a result, all short-term investments have seen their remuneration skyrocket. If the Livret A rate was capped at 3% by the French government, money market funds offered an average performance of 3.37%, according to Morningstar. Super-books and term accounts also made it possible to invest money without risk at a good price. For the first time in many years, financial institutions emerged from promotional campaigns with bonuses of up to 5%.

Only real estate will have really suffered from the context. Upset by the rise in the cost of credit on the one hand and by a reluctance of sellers to review their claims on the other, the market weakened. “For the first time in seven years, the number of sales of old homes has fallen below 900,000 transactions,” indicates Meilleurs Agents. Despite everything, a decline in prices has begun. This same actor estimates the decline in stone prices at the national level at 1.8%, a figure which should increase further. Holders of unlisted real estate funds have also noticed the paradigm shift: since the summer of 2023, nearly 25 real estate investment companies (SCPI) have seen their prices fall. And sometimes in significant proportions, with the biggest falls reaching 17%.

To make the right decisions at the start of 2024, two elements must therefore be particularly scrutinized: the rate of decline in inflation and the evolution of monetary policy. However, the first has tended to surprise downwards in recent months. In the eurozone, inflation rose “only” to 2.9% in December. In this context, a loosening of monetary policy becomes very likely, even if the timetable is much less likely. “We have reached a high point on key rates and the decline could occur more quickly than anticipated,” says Gilles Moëc, chief economist of the Axa group.

Precautionary saving remains attractive

For the saver, 2024 will therefore be both an extension of last year… while being different. Security products should remain attractive. This of course concerns precautionary savings vehicles, such as savings accounts and term accounts. However, their remuneration should gradually decline, with the exception of those of the A booklet and the sustainable and solidarity development booklet, the situation of which is frozen until January 2025. The popular savings booklet was the first victim of this decline: paid 6% last year, it now only delivers 5% to its current holders, due to the fall in inflation. On the life insurance side, the remuneration of funds in euros is also clearly trending upwards with returns driven by the markets and by the reserves of past years. This guaranteed asset should therefore regain interest – and flows – this year.

Stone enthusiasts will still have things to worry about! Less responsive than the listed markets, real estate will still need time to adjust to the new context. Communications from property management companies during the first half of the year will make it possible to measure the extent of the damage. There is indeed a fear that certain SCPIs will still suffer drops in valuation – which will be reflected in their prices. Especially since these supports must also integrate the structural changes which affect offices, with the rise of teleworking and energy regulations. However, for these products as for the entire real estate market, it will be necessary to exercise discernment because the period can be conducive to opportunistic investments at good prices…

The direction of risky assets is more difficult to understand. The stock markets risk blowing hot and cold. On the one hand, the confirmation of an easing of interest rates should generate euphoria. On the other hand, company results should dampen this enthusiasm somewhat if the economic slowdown – or even recession – materializes. The rise in equity markets in 2023 also calls for caution, as consolidation may take place. To invest, you will therefore have to be selective and methodical.

To navigate areas of turbulence, planned investment remains a safe bet: by regularly placing the same amount on the markets, this technique makes it possible to acquire a few securities when they are expensive and a larger quantity when they are good. walk. Another piece of advice: “You have to think long term and opt for themes with structural growth for the next five to ten years,” says Tom Lemaigre, manager within the European equities team at Janus Henderson Investors.

To build a well-balanced and defensive heritage, the key words remain diversification and decorrelation. Indeed, there is no point in stacking products if they evolve in the same way. Certain categories of investments can be very useful for this objective, such as real assets and pleasure investments. However, be careful of unpleasant surprises: scammers of all kinds lie in wait for poorly informed savers looking for excessive returns. The first rule of making money is not to lose it…

An article from the special report of L’Express “Investing in 2024: the right strategies in the face of an uncertain environment”, published in the weekly of February 15

.