The Swedish tax system calculates tax deductions on everything from work-related income to pensions.

The actual calculation of how much is to be deducted is based on which tax table you are placed in, based on where you live in the country. Different tax tables apply in different places in Sweden.

READ MORE: PRO’s alarm to pensioners: It hits the wallet hard

READ MORE: News today – current news from Sweden and the world

Important details of the tax on your pension

But how do tax deductions on pensions actually work? And why is 32 percent not deducted in tax if you have tax table 32? The Swedish Pensions Agency explains just that on the website under the post “This is how the tax deduction works on your pension in 2025“.

First of all, it is important to be aware that the tax tables are numbered from 29 to 42 and your tax rate is made up of the sum of your municipal tax, landing tax, funeral tax and any fees to the Church of Sweden or any other religious community.

DON’T MISS: This way you can increase your pension by SEK 10,000 a month

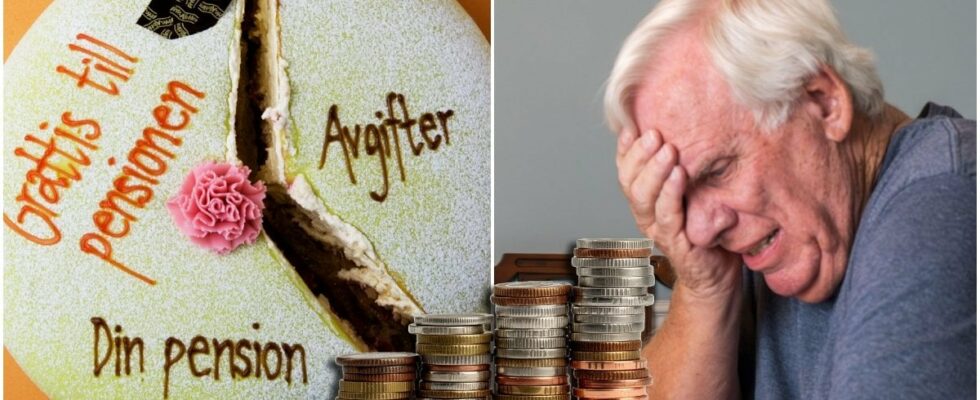

Therefore, too little tax can be deducted from the pension

But if, for example, you belong to tax table 32, that does not mean that you automatically have to pay 32 percent in tax. The reason for this is that your council tax is not your actual tax deduction.

“Simply explained, the tax you must pay depends on your age and the type of income the tax must be deducted from. You also pay more in tax, percentage-wise, the higher your income,” writes the Pensions Authority the website.

In the event that you have a high occupational pension that is paid to you every month, or a private pension for that matter, there is a risk that the tax deduction will be too low. Likewise if you live in a municipality with a high tax rate.

READ MORE: The allowance has not been increased for 13 years – you will get that much more in 2025

Then you must act to avoid residual tax on the pension

For you as a pensioner, it is important to be aware that it is you yourself who is responsible for sufficient tax being deducted from your total income, pension included. The pension authority and various payers implement not any coordination of payments and tax deductions.

To avoid residual tax on the pension, the Pensions Agency recommends that you:

DON’T MISS: Which food giant has the best bonus system? Here is the answer

DON’T MISS: Latest news – take part in what’s happening right now