(Finance) – The Wall Street stock exchange is moving in opposition, reopening its doors only today after the long holiday weekend. There is growing concern among investors that theaction by central banks to combat inflation ends up causing a global recession.

The attention of the insiders is now focused on minutes of the last meeting of the Federal Reservearriving tomorrow Wednesday 6 July, during which the cost of borrowing was increased by 75 basis points: the market expects another squeeze of the same size this month and sees rates at 3.25-3.5% by end of year.

Another important appointment is Friday, July 8, when it will be the turn of the employment data in the United States, where a slowdown in job growth is estimated in June. Today’s macroeconomic agenda, on the other hand, provides for an update on industry orders

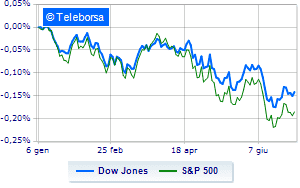

Among the US indices, the Dow Jones it is leaving 1.49% on the parterre; on the same line, a bad day for theS & P-500, which continues the session at 3,789 points, down 0.95%. Just above parity the Nasdaq 100 (+ 0.6%); slightly negativeS&P 100 (-0.6%).

Positive result in the S&P 500 basket for sectors secondary consumer goods (+ 1.43%) e telecommunications (+ 1.43%). In the list, the sectors power (-5.87%), utilities (-4.53%) e materials (-3.18%) are among the best sellers.

Between protagonists of the Dow Jones, Nike (+ 2.31%), Salesforce (+ 1.65%), Apple (+ 0.72%) e Home Depot (+ 0.67%).

The strongest sales, on the other hand, show up on United Healthwhich continues trading at -4.60%.

Letter on Chevronwhich records a significant decline of 4.25%.

Goes down Caterpillarwith a fall of 3.78%.

Collapses IBMwith a decrease of 3.76%.

To the top between tech giants of Wall Streetthey position themselves Zoom Video Communications (+ 6.84%), Datadog (+ 6.39%), Docusign (+ 6.17%) e Mercadolibre (+ 5.90%).

The strongest sales, on the other hand, show up on Exelonwhich continues trading at -6.87%.

Sales hands on Constellation Energywhich suffers a decrease of 6.55%.

Bad performance for Asml Holding Nv Eur0.09 Ny Registrywhich records a fall of 6.24%.

Black session for American Electric Powerwhich leaves a loss of 5.06% on the table.

Between the data relevant macroeconomics on US markets:

Tuesday 05/07/2022

4:00 pm USA: Industry orders, monthly (expected 0.5%; previous 0.6%)

Wednesday 06/07/2022

15:45 USA: Composite PMI (preceding 53.6 points)

15:45 USA: PMI services (preceding 53.4 points)

4:00 pm USA: Non-manufacturing ISM (expected 54.5 points; previous 55.9 points)

Thursday 07/07/2022

13:30 USA: Challenger layoffs (formerly 20.71K units).