For the past two years, civil real estate investment companies (SCPI) have been going through a difficult pass. These funds allowing to invest in a park of professional goods (offices, shops, clinics, warehouses, etc.) are however popular for their accessibility – a few thousand euros are enough – and their ability to pay regular remuneration. But they have been taken in a vicious circle since the rise in interest rates that occurred in 2022, leading to price reductions in their shares.

Real estate remains an essential placement and SCPIs offer an undeniable access and management, especially since all market products have not reacted in a similar way. In addition, the context should be more promising this year. “The drop in interest rates will lead to a decline in the yield of security savings products, which, in mirror, will allow real estate to become attractive again, analyzes Pierre Garin, real estate director of Linxea. In addition, this phenomenon will allow investors to finance credit operations again.” Another reassuring point: most of the SCPIs continue to pay dividends to their carriers. “There is no major risk on the rents perceived by partners because the majority of companies that occupy these goods are not in difficulty,” said Jérémy Orféo, co -founder of Welim.

This upturn should not make us forget the difficulties encountered by certain funds. “It is necessary to operate a drastic sorting, by putting aside the products with shares awaiting assignment, recommends Laurent Boissin, an expert in the real estate market. Be also attentive to the reconstruction value of SCPIs. This indicator, which reflects the value of the real estate heritage, must not be lower than the price on both sides to avoid a drop in the latter. Finally, caution with historical vehicles, still in the digestion of the crisis.”

As for new companies, they take advantage of a very opportune moment to invest in cheap, but they will not all find their audience. “We must take into account the quality and experience of managers because it is a profession that cannot be improvised,” warns Georges Nemes, the leader of the Patimmofi group. Also beware of the overly attractive yields displayed by certain SCPIs; They will not be tenable over time. “Projected over the coming years, good yields will be at 6 % maximum and not 8-10 %,” continues Georges Nemes.

Finally, a final precaution is essential: diversify your investments. “Do not bet everything on a manager, a theme or a country, a fortiori if you invest in credit, for a long time and important sums, advises Thierry Sevoumians, Deputy Managing Director of Zenith Investment Solutions in charge of real estate and insurance. It is better to carry out an allowance on 4 or 5 funds, or even a little more depending on the amounts invested.” An operation all the easier as the minimum subscription amount tends to be reduced.

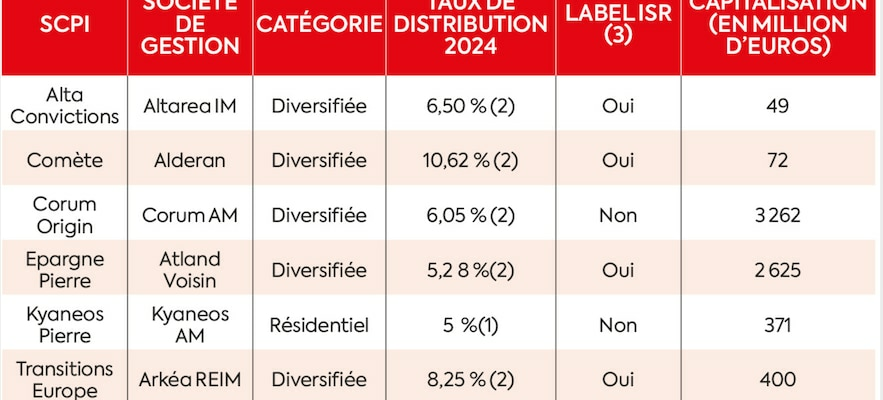

Here is our selection.

3842 CT SCPI Placements

© / 3842 CT SCPI Placements

Savings Pierre d’Atland Voisin

Recent among “historic” products, this SCPI created in 2013 by the neighboring Atland company invests in the majority in offices of large regional metropolises, even if its heritage also includes shops, warehouses and hotels…. It is very well diversified with more than 400 buildings in the portfolio and 1,000 tenants. This product displays a very healthy profile: a high occupancy rate, a limited debt and a reconstruction value greater than the price of almost 6 %. The 2024 distribution rate remained stable compared to 2023, greater than the market average.

Corum Origin of Corum AM

Emblematic product of Corum L’Epargne, this SCPI displays a very satisfactory performance history. It is also one of the vehicles that have pulled out of the game last year, continuing to massively attract collection and invest. “It is a SCPI of portfolio funds with a great granularity of assets and tenants, which has proven itself both on the distribution and on the revaluation of the part,” said Jérémy Orféo. Diversified on the sectoral and geographic levels, Corum Origin distributed 6.05 % in 2024, in line with its long -term objective. “SCPIs of this size at more than 6 % yield, there are not much,” admits Pierre Garin.

Arkea Reim Europe transitions

A handful of young SCPIs have been able to capture a lot of savings in the past two years. This has enabled them to build up a very profitable heritage, the value of which can be appreciated when interest rates will decrease. Launched at the end of 2022, Europe transitions was one of them. This vehicle is investing in diversified assets (office, health, education, logistics, etc.), in line with real estate market developments in Europe. It displays a distribution rate of 8.25 % in 2024, after 8.16 % in 2023. “This is an experienced manager belonging to a solid group, the Crédit Mutuel Arkéa, whose banking network and the life insurance company can be of precious support,” points out Thierry Sevoumians. A bank support from which two other products are not benefited from the same period and also well positioned: remake Live, from remake Am, and Iroko Zen, from Iroko.

Alta convictions of Altarea IM

With just over a year on the clock, Alta Convictions is a recent SCPI, and the very first of the Altarea group, which is nevertheless a seasoned real estate company. Its positioning consists in investing opportunistically in goods (office, health, logistics) adapted to real estate transformations resulting from changes in working, consumption, residence, and environmental standards … The target distribution rate is set at 6.50 % (held in 2024) and the price per share was raised from 300 to 305 euros last December to highlight the good health of the product.

Comet of Alderan

Known for its SCPI Activimmo, specializing in French logistics, Alderan released its new baby at the end of 2023: comet. The latter is intended to be complementary to its elder: it therefore invests outside France and in all sectors, knowing that, concerning logistics, only assets outside the euro zone can be targeted. The management company thus gives itself a wider hunting ground, which can allow it to support the expansion of its current tenants. The target distribution rate for 2024 exceeded 10 % in annualized. “But landing should rather be around 6-6.5 %,” warns Thierry Sevoumians.

Kyaneos Pierre de Kyaneos Am

A real UFO on the planet SCPI, Kyaneos Pierre specializes in the residential segment. Its strategy is based on the renovation of old buildings in the region, in order to improve the quality of housing. “It is a clearly identified positioning, in a resilient area, implemented by a committed company,” appreciates Laurent Boissin. It also manages a SCPI eligible for the Denormandie device, focused on the energy renovation of buildings. Its regular yield amounted to 5.28 % in 2023. The share price was also noted by two euros in the summer of 2024 in order to reflect the proper valuation of the heritage.

An article in the special file “Placements: our 40 advice for 2025”, published in the Express of February 20.