of the Russian state budget is missing more than 2.8 trillion rubles, or about 27 billion euros.

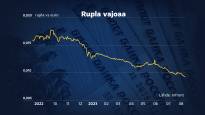

The situation is worsened by the depreciation of the ruble.

To ease the plight, the Kremlin decided at the beginning of August on a new tax, with which companies that made large profits during the war are obliged to pay an additional one-time payment.

In Europe and the United States, the tax is often called a windfall tax and is collected from the occasional excess profits of large companies.

Senior advisor at the Bank of Finland Laura Solanko assesses that the reason behind the tax is Russia’s acute need for money.

The tax is actually a kind of “war tax”, with which Russia tries to fill the state coffers emptied by the war.

– The increase in Russian spending is due to the war and especially the increase in defense sector spending. Without the war, such an additional tax would hardly have been introduced, says Solanko.

The acute need for money is indicated by the fact that the Kremlin has promised a lower tax rate for companies that pay the extra tax before November.

Watch the video to see what the windfall tax is all about:

The Kremlin’s way of involving the oligarchs in “war talks”

The Kremlin according to the new tax about 2,500 Russian and foreign export companies will have to pay, which benefited from the sharp rise in the prices of raw materials last year.

Independent Russian media Medusa According to the Russian tax bear, it mainly hits fertilizer and metal export companies, i.e. large companies headed by Russian oligarchs.

For example, an oligarch Ališer Usmanov founded by Metalloinvest and an oligarch by Vladimir Potanin led by Nornickel are among the payers. In addition, the list includes state-owned companies, such as the nuclear power company Rosenergoatom.

– Russia is now trying to scrape additional income from where it can be obtained. Additional income is now available from large companies. There are currently no other significant sources of additional income in Russia, Solanko estimates.

The tax may also be related to the mutual quarreling of the elite of the Russian business world.

During the war, Russia has taxed oil and gas companies more heavily than other industries, for example mining. The taxation of the metal sector has been discussed in Russia for years without success.

– It has been made clear to the Russian business world, officially and unofficially, even before the tax, that everyone is expected to participate in the war project, says Solanko.

The effects on international companies remain to be seen.

Dozens of foreign companies such as Mondelez and Heineken still operate in Russia, and they may have to pay the “war tax”.

Finnish companies will probably not be affected by the tax, as large Finnish companies withdrew from Russia after the start of the war.

Nothing prevents tax money from ending up for war purposes

The Kremlin has not directly admitted that the money would go to Putin’s war chest.

During the preparation of the law in June, the Minister of Finance Anton Siluanov saidthat tax money would be used to pay for social expenses and support families with children.

The Duma can use tax money only for the purposes specified in the legislation. Regarding the profits of large companies in the tax regulation destination for tax money has not been defined.

The decree says that the tax will be collected in the Russian state budget. The government decides on the use of budget funds.

Solanko estimates that the tax will not necessarily remain a one-off. According to the expert, as the war drags on, the tax burden on the Russian business sector will probably increase.

Is the Russian economy at the point of collapse?

Talk of the weakening of the ruble and the end of the war as a result of Russia’s economic collapse has increased.

– It seems that now for one reason or another they are hoping for and looking for a collapse. The exchange rate of the ruble is psychologically important for many, but the Russian economy is unlikely to be swayed by the ruble’s weakening, Solanko reflects.

Paradoxically, despite the talk of collapse, Russia’s gross national product has grown during the war.

– In the simplest terms, digging trenches increases GDP. However, it does not say anything about the state of the Russian economy or its well-being, Solanko explains.

Solanko compares the state of the Russian economy to patching pants with holes.

– Even if GDP growth looks decent right now, it does not mean that patching measures are being carried out all the time, which are harmful to long-term growth.

The “trousers” of the Russian economy have recently been patched by increasing public spending, raising interest rates, additional taxes on state-owned enterprises and a new “war tax”.

According to Solango, the budget rule and the tax on large companies will not solve the problems related to Russia’s deficit.

Taxation of excessive corporate profits would bring the Russian state coffers about 300 billion rubles, or about three billion euros, when the need is 27 billion euros.

In addition, Russia has a number of other problems that could weaken its economy in the long run.

– Foreign banks hardly lend to Russian companies or banks. Investors are shunning Russian companies and debt securities, and the capital flow tends to leave Russia because the business conditions are weak, says Solanko.

Solanko considers it unlikely that the Kremlin would make significant cuts or increase the value-added tax in the near future in order to patch up the state budget.

Presidential elections will be held in Russia next year. Solanko estimates that the cuts and tax increases would affect the president Vladimir Putin support negatively, and therefore do not intend to take them on.

You can discuss the topic until 11 p.m. on August 19.