With rising interest rates, solid returns in 2023, and a very promising start to 2024, the sky is clearing for savers. A flexible tool with preferential taxation, life insurance is once again becoming attractive and the safest of banking investments. However, in a context of inflation, diversification remains the wisest course. Identify your needs, identify the different products available, negotiate your contract, go through a management company, monitor costs, generate long-term performance: L’Express guides you.

About-face. This is how savers could describe the change in commercial discourse they are facing when it comes to life insurance. Barely two years ago, the euro fund was still a pariah and most of the market imposed partial payment requirements on units of account, unsecured supports, for those who wanted to access them. Its plummeting performance also provided a strong argument to turn away from it. But today, the panorama has completely changed! Not only have the constraints on access to the fund in euros been lifted, but insurers welcome savers wishing to pay tidy sums into it with open arms.

A sudden reversal of strategy

What fly has bitten them? It is to the side of interest rates that we must turn to understand this sudden reversal of strategy. Between the end of 2021 and 2024 today, the ten-year French debt ratio increased from 0 to almost 3%. A change in environment which is not without consequences for life insurance since the euro fund is made up of three-quarters of bonds. “Two years ago, insurers invested in securities with very low yields,” explains Claude-Florence Chassain, partner at Deloitte. As a result, the new payments made to the fund in euros diluted the yield of the old ones. Today “Today, the remuneration of bonds is more attractive, which allows the opposite phenomenon.”

Moreover, the rates paid to policyholders have also increased significantly. The market average for 2023 is estimated at 2.60% net of management fees but gross of social security contributions, a level that has not been seen for a decade. “This shows the resilience of the euro fund, even if we cannot speak of a strong rebound but rather of a gradual increase in returns thanks to the use of wealth accumulated in the past,” continues Claude-Florence Chassain. Because euro funds still benefit little from the effect of rising rates. To do this, you must be able to invest in the markets and acquire well-paying securities. However, the French abandoned this placement last year.

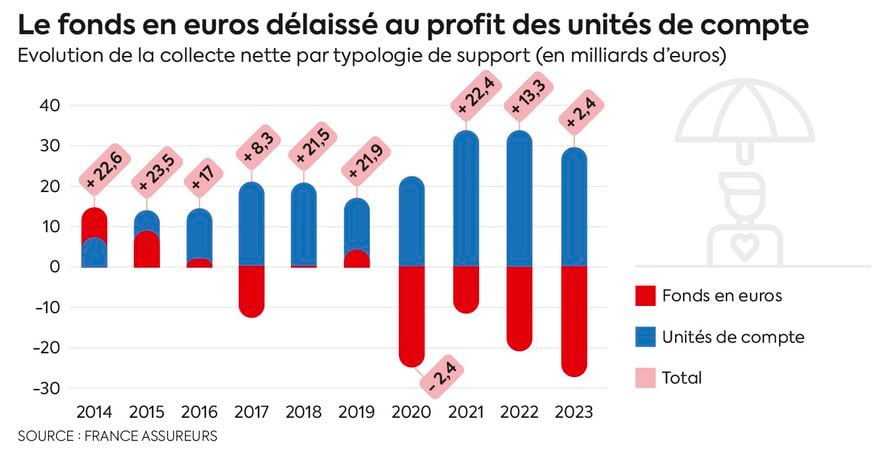

While the net collection amounted to 2.4 billion euros, it actually benefited the units of account. This category of support attracted 30 billion euros when 27.6 billion came out of euro funds. However, companies regularly renew part of their portfolio when certain old bonds mature and are repaid. They were able to reinvest at higher rates.

Insurers’ reserves, a real war chest

But this was not enough: most had to draw on their reserves, called provisions for profit sharing (PPB) in the jargon of the profession. Each year, insurers have the possibility of distributing their earnings to policyholders or setting aside part of them. These sums belong to the policyholders and must, in any case, be paid to them within eight years.

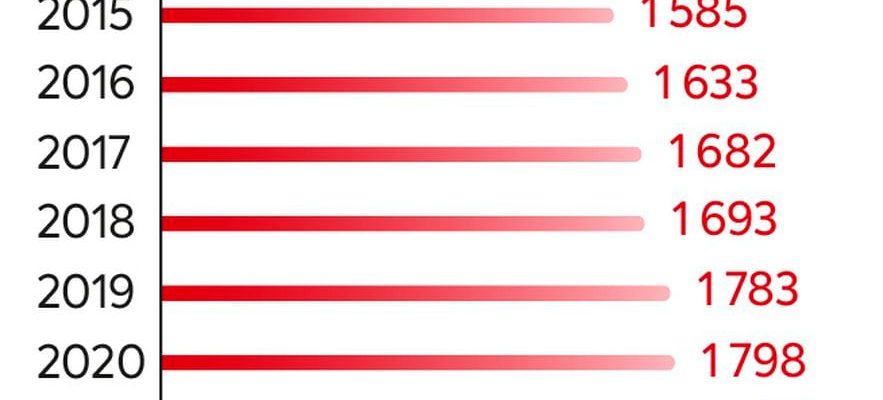

Growing outstandings

© / The Express

In recent times, this war chest had grown significantly at the professional level. Insurers belonging to banking groups are the main holders. “We have shown prudence by building up solid financial reserves during periods of low rates,” says Philippe Perret, general manager of Société Générale Assurances, the insurer of contracts distributed by the SG bank. Today, we can redistribute a portion with the aim of maintaining a very competitive euro fund for many years, after allocation, our reserves remain high at 7.2% of our assets for Sogecap.” Same speech at BNP Paribas Cardif. “We increased our rate of return by 1% in 2023 because it seemed important to us to react to the rise in rates and inflation, indicates Fabrice Bagne, deputy general manager of the insurer, responsible for France. To do this , we have drawn on our reserves which are provided for this type of situation.”

Customers to pamper

Not everyone can say the same. Whether for management or strategic reasons, certain players find themselves much less fortunate in terms of wealth. And this risks weighing on their performance in the future. “We are starting to see, and we will see it even more in the coming years, the difference between insurers,” estimates Claude-Florence Chassain. If certain players, like Afer, were hampered in their efforts to deliver a competitive 2023 rate to their clients, they were able to count on buoyant markets to obtain a decent performance. “The year 2023 was good financially, underlines Benoit Courmont, member of the management committee of the AG2R La Mondiale group responsible for retirement and wealth savings, activities linked to aging well and the monetization of wealth of Seniors If we were to experience a market shock in the coming years, it would probably be harder for unqualified players.”

NEW3797CT LIFE INSURANCE Funds in euros waived

© / The Express

One certainty remains: the euro fund is an ocean liner, managed over the very long term. Therefore, its performance changes less quickly than that of other products, such as savings accounts or term accounts. As a result, competition was fierce last year with these supports. “Following the rebound in interest rates, banks made term accounts available which paid 3 or 4% over one year, i.e. a return higher than that of the euro fund at the time, which penalized life insurance last year”, explains Patrick Thiberge, Managing Director of Meilleurtaux Placement. Hence the need to pamper customers now by serving competitive rates.

The period is pivotal: “Insurers want to take advantage of the moment to attract liquidity and buy better-paying bonds in anticipation of a future drop in rates,” continues Patrick Thiberge. To do this, they are using bonus policies, which consist of increase the remuneration of the fund in euros in 2024 and sometimes in 2025 for new subscriptions or additional payments.” These offers have flourished in recent months, to the delight of savers wishing to invest some cash securely. Often, they improve the performance of the fund in euros by 1.5 or 2%. “There are opportunities because this makes it possible to obtain a net rate of 4.60% for a guaranteed capital investment. This is a godsend for risk-averse savers!”, underlines Patrick Thiberge.

These attractive levels, combined with the solidity of 2023 returns, seem to convince savers. Especially since life insurance retains advantages that short-term investments do not have, particularly in terms of transmission. Thus, the professional association France Assureurs communicated on massive payments in January 2024. “In the first month of 2024, life insurance contributions reached their absolute record, at 15.9 billion euros, in increase of +12% over one year”, she indicates in her monthly update. Professionals are confident that this dynamic will continue throughout the year. “The months of January and February 2024 are much higher in terms of activity than the first two months of 2023, remarks Virginie Hauswald, general director of the Garance mutual. We are having a very good start to the year and are seeing a renewed interest in life insurance, which is sometimes favored over real estate investment.”

Last year’s competing supports also appear less fierce. “We are betting that a large part of the term accounts taken out last year will expire,” explains Benoit Courmont. “If we are able to offer competitive rates, with all the advantages of insurance -life, customers will come back.” However, with the anticipation of an upcoming rate cut by the European Central Bank (ECB), banking establishments are being less generous in remunerating their clients’ liquidity and the advantage could return to the euro fund.

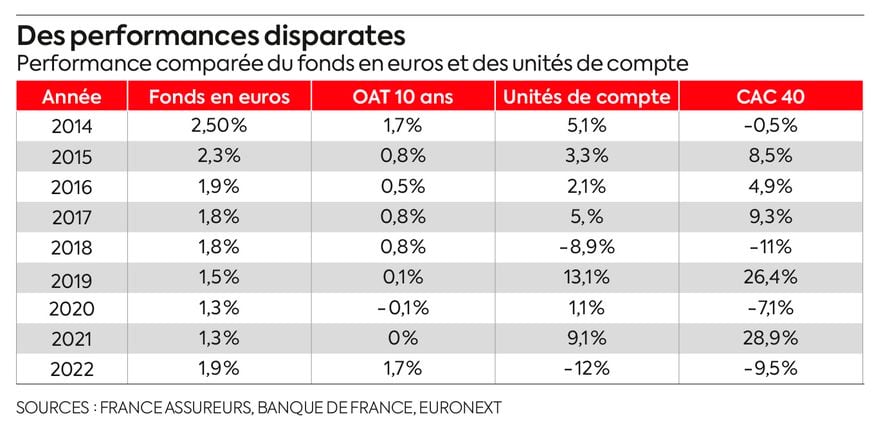

NEW3797CT_Disparate performance

© / The Express

It remains to be seen whether savers will once again want to bet everything on a secure medium, while 41% of payments were allocated to units of account last year, a level which is not weakening at the start of 2024, well into opposite. The answers vary according to customer segments and company incentives, but a 100% guaranteed return does not seem to be the case. “Even if its share is increasing, we are not seeing a massive return on the euro fund,” says Gregory Guermonprez, director of Fortuneo. Conversely, the dynamic remains strong on the units of account, especially as performances have was there.”

Indeed, last year, both stocks and bonds recorded strong increases, which will continue over the first months of 2024. And even in the event of a market reversal, the scenario seems unlikely, especially since the unit of account offering has become greatly diversified. “The units of account allow significant diversification, especially since there are now very structured supports which can limit the risk taken by the subscriber,” notes Claude-Florence Chassain. Inflation also remains on people’s minds: it reached 4.9% in 2023 and could reach 2.6% in 2024. To achieve superior performance, excluding one-off bonuses, diversification seems inevitable. However, insurers are not opposed to a rebalancing in favor of the guaranteed asset. Benoit Courmont concludes: “The euro fund still has a bright future ahead of it.”

An article from the special “Placements” section of L’Express, published in the weekly on April 11.

.