Bad news for the French economy. The OECD sharply reduced, on Wednesday November 29, 2023, its growth forecast for 2024 in France, dropping it to 0.8% compared to 1.2% in September, two days before the update of the financial note of the ‘Hexagon by the S & P Global agency.

According to economic forecasts from the Organization for Economic Co-operation and Development published on Wednesday, the international environment “will limit exports”, and rising interest rates “will weigh on private investment and consumption” in France l next year. In its 2024 draft budget presented in September, the government said it was counting on growth of 1.4%, deemed “high” by the High Council of Public Finances. The International Monetary Fund (IMF) for its part anticipates a 1.3% increase in GDP in 2024, and the Bank of France 0.9%.

A rating from the S&P Global rating agency

France’s economic situation is being particularly scrutinized this week because the rating agency S&P Global must update the rating it gives to France on Friday, currently “AA”, but with a negative outlook. Before S&P Global, the Fitch agency maintained France’s rating at “AA-” at the end of October, and Moody’s had not updated its credit rating.

In its report published Wednesday, the OECD also said it expects GDP growth of 0.9% this year after having anticipated 1% in its previous forecasts in September, the same forecast at the time as that of the government . The international organization, on the other hand, forecasts a more robust recovery in 2025 with GDP growth of 1.4%, as inflation eases and international demand picks up.

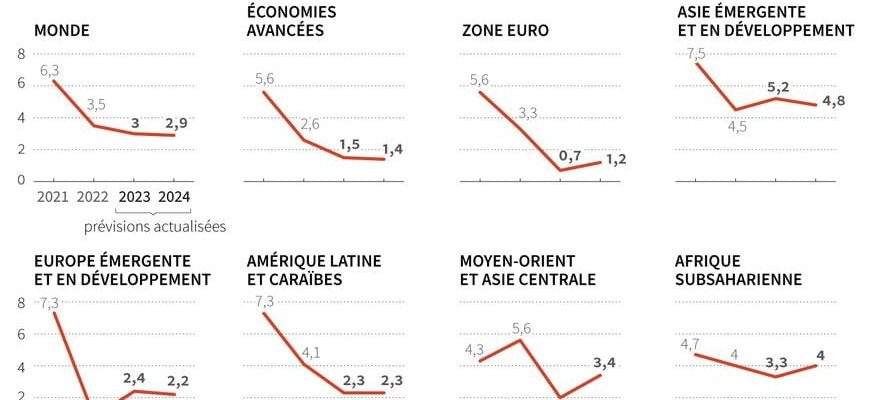

IMF growth forecast

© / afp.com/Maxence D’AVERSA

Stubborn inflation

Inflation is still stubborn for the moment: it should be 5.5% in the euro zone as a whole and 2.9% next year, forcing the European Central Bank (ECB) to maintain a tone firm regarding the level of interest rates it sets.

High inflation has a direct effect on growth within this zone, expected by the OECD at 0.6% this year and 0.9% next year, respectively stable and down 0.2 points. compared to the institution’s previous forecasts in September.