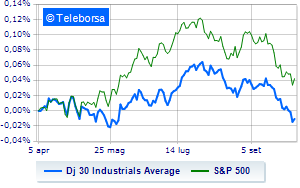

(Finance) – Wall Street crosses the halfway mark of the session at the levels of the day before, reporting a change of -0.04% on the Dow Joneswhile, on the contrary, theS&P-500 advances fractionally, reaching 4,242 points. Good performance Nasdaq 100 (+0.86%); as well as slightly positiveS&P 100 (+0.34%).

Prudence has been characterizing market sessions for some time now with investors’ attention remaining focused on central banks. The pressure on the issue of interest ratesin fact, remains high: several representatives of the Federal Reserve they reiterated their forecast of high rates for a long time; to them, was echoed from across the ocean, the President of the ECB, Christine Lagarde which confirmed Frankfurt’s position for a sufficiently restrictive monetary policy as long as it is functional in curbing inflation.

In the meantime, the race of government bond yields on a global level, which had gained strength since yesterday afternoon, when the opening of new jobs in the United States reached the largest increase in two years in August, thus strengthening expectations that the American central bank will maintain high rates for a period prolonged.

Positive result in the S&P 500 basket for sectors secondary consumer goods (+1.42%), materials (+1.02%) e telecommunications (+0.84%). At the bottom of the S&P 500 ranking, significant declines are evident in the sectors power (-3.48%) e utilities (-0.42%).

To the top between giants of Wall Street, Microsoft (+1.43%), Salesforce (+1.17%), Amgen (+1.11%) e Wal-Mart (+1.07%).

The steepest declines, however, occur at Chevronwhich continues the session with -2.43%.

The negative performance of Boeingwhich falls by 1.85%.

Moderate contraction for Walgreens Boots Alliancewhich suffers a decline of 1.46%.

Undertone Verizon Communications which shows a reduction of 1.39%.

On the podium of Nasdaq stocks, Tesla Motors (+4.68%), Trade Desk (+3.93%), ASML Holding (+3.28%) e Paccar (+2.86%).

The worst performances, however, are recorded on DexComwhich gets -5.54%.

At a loss Diamondback Energywhich falls by 3.85%.

Baker Hughes Company drops by 3.34%.

Decline decided for Zoom Video Communicationswhich marks -2.47%.