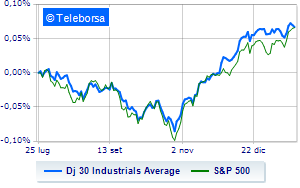

(Finance) – On Wall Street, the Dow Jones is substantially stable and is positioned at 37,936 points, while, on the contrary, theS&P-500 proceeds in small steps, advancing to 4,892 points. On the rise Nasdaq 100 (+1.23%); following the same trend, theS&P 100 (+0.86%).

The focus is on the quarterly reports after that Netflix announced a record number of new users in the fourth quarter (+13.1 million). Investors’ attention always remains focused on the company’s next moves Federal Reservewhile the hypotheses of a first cut in interest rates, already in March, are fading.

Insiders await the preliminary reading of the Fourth quarter GDPscheduled for tomorrow January 25th, and personal incomes and consumption expenditure for December which also include the data PCE on inflation, expected on Friday. which will give further indications to the Fed in view of rate decisions.

Telecommunications (+1.78%), informatics (+1.60%) e financial (+0.76%) in good light on the S&P 500 list. At the bottom of the ranking, the greatest declines occur in the sectors utilities (-1.49%), materials (-0.96%) e office consumables (-0.79%).

Among the best Blue Chips of the Dow Jones, Boeing (+2.04%), Microsoft (+1.41%), Chevron (+1.26%) e American Express (+1.04%).

The worst performances, however, are recorded on Verizon Communicationswhich obtains -1.63%.

Lame Dowwhich shows a small decrease of 1.19%.

Modest descent for Johnson & Johnsonwhich drops a small -0.85%.

Thoughtful Nikewith a fractional decline of 0.82%.

Between protagonists of the Nasdaq 100, Netflix (+12.44%), ASML Holding (+10.06%), Advanced Micro Devices (+6.27%) e Applied Materials (+4.69%).

The strongest sales, however, occur at Baker Hughes Companywhich continues trading at -4.11%.

Goes down Datadogwith a decline of 3.81%.

Under pressure GE Healthcare Technologieswhich suffered a decline of 2.86%.

It slides Vertex Pharmaceuticalswith a clear disadvantage of 2.60%.