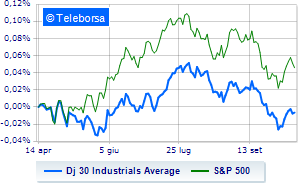

(Finance) – On Wall Street, the Dow Jones is substantially stable and stands at 33,668 points, while, on the contrary, theS&P-500, which continues the day below par at 4,327 points. Negative the Nasdaq 100 (-1.26%); on the same trend, slightly decreasingS&P 100 (-0.67%).

Yesterday’s US inflation data fueled speculation about longer-term higher interest rates from the Fed, while weak Chinese price data released this morning raised concerns about the global economy. In the meantime, the quarterly reporting season has started: accounts from big Americans have arrived, such as: Blackrock, JPMorgan, Citigroup, Bank of America and Wells Fargo.

The sectors are in good evidence in the S&P 500 power (+2.40%), utilities (+0.91%) e office consumables (+0.80%). Among the most negative on the S&P 500 list, we find the sectors informatics (-1.49%), secondary consumer goods (-1.43%) e telecommunications (-1.41%).

At the top of the rankings American giants components of the Dow Jones, United Health (+2.44%), JP Morgan (+2.12%), Chevron (+2.01%) e Travelers Company (+1.75%).

The steepest declines, however, occur at Boeingwhich continues the session with -3.32%.

The negative performance of Intelwhich fell by 2.33%.

Walgreens Boots Alliance drops by 2.05%.

Nothing done yet IBMwhich changes hands on parity.

On the podium of Nasdaq stocks, Sirius XM Radio (+4.36%), Diamondback Energy (+2.94%), Kraft Heinz (+2.01%) e Intuitive Surgical (+1.71%).

The strongest sales, however, occur at Trade Deskwhich continues trading at -4.46%.

Breathless ON Semiconductorwhich fell by 4.29%.

Thud of NXP Semiconductorswhich shows a fall of 4.20%.

Letter about Marvell Technologywhich recorded a significant drop of 3.84%.