(Tiper Stock Exchange) – Wall Street is in sharp decline after macroeconomic data released before the opening showed personal consumption spending rose more-than-expected in January, raising fears the Federal Reserve will keep interest rates higher for longer. In particular, the performance of the core PCE index is worryingthe main measure of inflation used by the US central bank.

“It is evident that these data they confirm the fears of more hawkish members within the FOMC of the Federal Reserve – commented Filippo Diodovich, Senior Market Strategist of IG Italia – Core inflation proves to be persistent at high levels and not yet on a return path towards the 2% target. As the US labor figures also showed, the US economy still remains overheated and will need more central bank action to cool it down.

Meanwhile, Loretta Master, chairman of the Federal Reserve Bank of Cleveland, said key interest rates need to climb above 5% and stay there for some time. Mester e herself will speak during the session Philip Jeffersonwhich sits on the Federal Reserve Board of Governors.

According to a research by Bank of Americaquoting EPFR Global data, i global equity funds they lost $7 billion in outflows in the week to Feb. 22, while $3.8 billion was left in cash funds. Analysts believe investors are preferring bonds as they prepare for the risk that the Federal Reserve persists with aggressive moves.

On the front of quarterly, Carvana (e-commerce platform for buying and selling used cars) reported its net loss widened in 2022 as used car demand fell. Also Beyond Meat (a US manufacturer of meat substitutes and plant-based dairy products) reported a higher loss for the year, although it provided encouraging guidance. farfetch (online platform for the sale of fashion, luxury and design goods) saw revenue growth slow in the fourth quarter of 2022, but remains positive on 2023.

Among the titles under observation there is boeingafter it has temporarily halted deliveries of its 787 Dreamliners due to a documentation problem with a fuselage component. Deliveries will not resume until the Federal Aviation Administration (FAA) is satisfied that the issue has been resolved, the agency said.

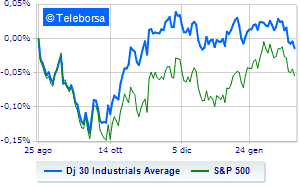

TO Wall StreetThe Dow Jones it is down (-1.07%) and stands at 32,798 points; along the same lines, theS&P-500 it lost 1.24%, continuing the session at 3,963 points. Bad the NASDAQ 100 (-1.62%); as well, negative theS&P 100 (-1.28%).