(Finance) – Wall Street fell in mid-session on the day of US inflation data that slowed in April, reducing the probability of further rate hikes by the Federal Reserve.

In the background remains the imminent threat to markets posed by a potential US debt crisis which will intensify during the summer months as the US is likely to breach the $31.4 trillion debt ceiling. This requires a legislative solution, but currently, Democrats and Republicans are still divided on how to resolve the issue.

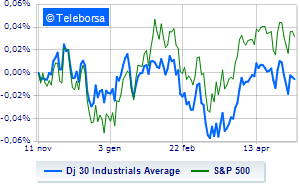

Among US indices, the Dow Jones is down (-0.83%) and stands at 33,282 points: theamerican index thus continuing a negative series, which began last Monday, of three consecutive reductions; along the same lines, it yields to sales theS&P-500which recedes to 4,104 points.

Consolidate the levels of the eve the NASDAQ 100 (+0.13%); in fractional decline theS&P 100 (-0.28%).

In the S&P 500, no fund is saved. In the list, the worst performances are those of the sectors power (-1.71%), industrial goods (-1.30%) and financial (-1.21%).

Between protagonists of the Dow Jones, Salesforce, (+1.65%) and Microsoft (+1.06%).

The strongest declines, however, occur on American Expresswhich continues the session with -2.59%.

They focus their sales on Nikewhich suffers a drop of 2.18%.

Sales on Walt Disneywhich records a drop of 1.77%.

Bad sitting for Visawhich shows a loss of 1.67%.

To the top between Wall Street tech giantsthey position themselves Datadog (+7.47%), Zscaler (+7.35%), Illuminate (+6.04%) and Rivian Automotive (+4.47%).

The strongest sales, on the other hand, show up AirBnbwhich continues trading at -10.28%.

Breathless Warner Bros Discoverywhich falls by 4.33%.

Thump of PayPalwhich shows a fall of 3.83%.

Under pressure Marriott Internationalwhich shows a drop of 3.26%.

Between macroeconomic variables of greatest weight in the North American markets:

Wednesday 10/05/2023

2.30pm USA: Consumption prices, yearly (expected 5%; previous 5%)

2.30pm USA: Consumption prices, monthly (expected 0.4%; previous 0.1%)

4.30pm USA: Oil Inventories, Weekly (Exp -917K barrels; prev -1.28M barrels)

Thursday 11/05/2023

2.30pm USA: Production prices, yearly (expected 2.5%; previous 2.7%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 245K; Previously 242K).