(Finance) – The Wall Street stock market continues to be cautious, confirming the caution of the start, with investors’ eyes focused on the central banks, in the week in which speeches from various central bankers are expected, while fears over the conflict remain in the background in the Middle East. Expected

Tomorrow, Thursday, the speeches of the Fed President, Jerome Powell and the President of the European Central Bank Christine Lagarde are expected. Meanwhile, comments from some Federal Reserve officials in the last few hours have suggested that the US central bank may not yet be done raising interest rates.

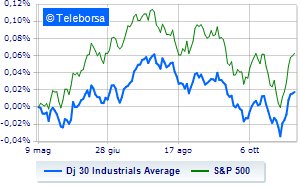

Among US indices, the Dow Jones it is substantially stable and stands at 34,095 points; on the same line, theS&P-500 (New York), which is positioned at 4,380 points, close to previous levels. On equality the Nasdaq 100 (+0.07%); on the same trend, without direction theS&P 100 (+0.12%).

Appreciable increase in the S&P 500 for the sector informatics. Among the most negative on the S&P 500 list, we find the sectors utilities (-1.32%), power (-0.90%) e office consumables (-0.50%).

The only Blue Chip of the Dow Jones is substantially up Microsoft (+0.66%).

The worst performances, however, are recorded on Walgreens Boots Alliancewhich gets -2.76%.

Prey for sellers Intelwith a decrease of 1.90%.

He hesitates 3Mwhich lost 1.42%.

Basically weak Travelers Companywhich recorded a decline of 1.23%.

On the podium of Nasdaq stocks, Fortinet (+2.92%), Zscaler (+2.15%), Paypal (+1.95%) e ANSYS (+1.84%).

The strongest sales, however, occur at Warner Bros Discoverywhich continues trading at -16.88%.

Negative session for Polishedwhich falls by 8.14%.

Significant losses for Biogendown 5.88%.

Breathless Modernwhich fell by 4.06%.