(Finance) – The Wall Street stock market continues at two speeds the day after the Federal Reserve raised the cost of money by 25 basis points, as expected by the market, bringing interest rates to the highest level in seven years. In the post-decision press conference, the Fed Governor Jerome Powell he announced further rate hikes, but at the same time comforted investors by stating that the disinflationary process had begun.

On the macro front, the number of US workers filing for jobless benefits for the first time fell to its lowest level since last April, which was unexpected as analysts were expecting a rise.

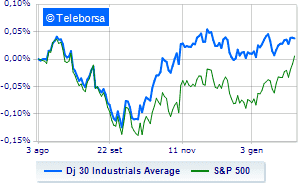

Among US indices, the Dow Jones the session continued at the previous levels, reporting a variation of -0.14%; while, on the contrary, theS&P-500, which comes in at 4,187 points. Leap up the NASDAQ 100 (+3.86%) thanks to the performance of the Meta share after a positive quarterly. The other big techs, Alphabet and Amazon, will publish their respective accounts after the close of today’s session; with similar direction, revving theS&P 100 (+2.09%).

Between protagonists of the Dow Jones, Microsoft (+3.66%), intel (+3.53%), Home Depot (+3.47%) and Walt Disney (+3.19%).

The strongest sales, on the other hand, show up United Healthwhich continues trading at -5.28%.

It collapses Merckwith a drop of 4.47%.

In red Travelers Companywhich shows a marked decrease of 2.61%.

The negative performance of Amgenwhich drops by 2.54%.

Between best performers of the Nasdaq 100, Align Technology, (+28.87%), document sign, (+7.77%), zscaler, (+7.50%) and Amazon (+7.22%).

The strongest sales, on the other hand, show up Sirius XM Radiowhich continues trading at -9.90%.

Hands-on sales Pinduoduo, Inc. Sponsored Adrwhich suffers a decrease of 4.06%.

Bad performance for Vertex Pharmaceuticalswhich records a drop of 3.83%.

Gilead Sciences, drops by 3.43%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 02/02/2023

1.30pm USA: Challenger Layoffs (previously 43.65K units)

2.30pm USA: Unit labor cost, quarterly (expected 1.5%; previous 2%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 200K; Previously 186K)

2.30pm USA: Productivity, Quarterly (Expected 2.4%; Previous 1.4%)

4:00 pm USA: Industrial orders, monthly (expected 2.3%; previous -1.9%).