(Finance) – The main stock exchanges of the Old Continent were all positive. The US price list moves up well, where theS & P-500 marks an increase of 0.79% on the day of the expected price data in the United States, which rose more than expected but below the levels of the previous month.

On the currency market, theEuro / US dollar, which trades on the eve of 1.054. Plus sign forgold, which shows an increase of 0.80%. Euphoric session for crude oil, with oil (Light Sweet Crude Oil) showing a jump of 5.44%.

Excellent level of spreadwhich drops to +190 basis points, with a decrease of 11 basis points, with the yield of the 10-year BTP reaching 2.90%.

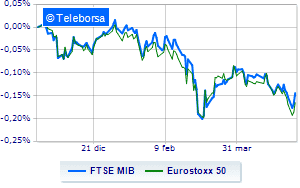

Among the markets of the Old Continent incandescent Frankfurtwhich boasts an incisive increase of 2.17%, a decidedly positive balance for London, which boasts a progress of 1.44%; in the foreground Paris, which shows a strong increase of 2.50%. Euphoric session for Piazza Affari, with the FTSE MIB which shows a jump of 2.84% in closing; on the same line, brilliant day for the FTSE Italia All-Sharewhich ends at 25,868 points.

On the Milan Stock Exchange, the exchange value in today’s session it was equal to 2.14 billion euro, remaining unchanged compared to the previous session; the volumes traded went from 0.63 billion shares of the previous session to today’s 0.55 billion.

Between best performers of Milan, in evidence Unicredit (+ 10.79%), Banca Generali (+ 6.32%), CNH Industrial (+ 4.54%) e Mediolanum Bank (+ 4.51%).

The worst performances, however, were recorded on Recordatiwhich closed at -0.94%.

At the top among Italian stocks a mid cap, Ferragamo (+ 10.08%), Brembo (+ 9.33%), Tod’s (+ 5.99%) e Mfe A (+ 5.98%).

Stronger sales, on the other hand, fell on GVSwhich ended trading at -7.79%.

At a loss Wiitwhich falls by 2.84%.

In red Datalogicwhich shows a marked decline of 1.56%.

The negative performance of Maire Tecnimontwhich falls by 1.01%.

Between macroeconomic quantities most important:

Wednesday 11/05/2022

03:30 China: Production prices, annual (7,7% expected; previous 8,3%)

03:30 China: Consumption prices, annual (expected 1.8%; previous 1.5%)

08:00 Germany: Consumption prices, yearly (7.4% expected; previous 7.3%)

08:00 Germany: Consumption prices, monthly (expected 0.8%; previous 2.5%)

14:30 USA: Consumer prices, yearly (8.1% expected; 8.5% before).