With rising interest rates, solid returns in 2023, and a very promising start to 2024, the sky is clearing for savers. A flexible tool with preferential taxation, life insurance is once again becoming attractive and the safest of banking investments. However, in a context of inflation, diversification remains the wisest course. Identify your needs, identify the different products available, negotiate your contract, go through a management company, monitor costs, generate long-term performance: L’Express guides you.

The French have adopted units of account, these unguaranteed supports which allow investment in the markets. In 2023, more than 4 euros paid out of 10 went to these products. And despite significantly increasing returns on the euro fund, they remain of great interest. “The first reflex is to diversify your contract beyond the general assets to obtain superior performance, recommends Patrick Thiberge, general manager of Meilleurtaux Placement. Especially since in the coming years, the return of the fund in euros risks stabilize around 2 or 3% when bonuses dry up, which will not cover inflation.” But selecting the right funds is not easy, especially since some contracts reference several hundred units of account.

A first step is to clearly identify your needs. “You have to start from your investment horizon, which is the fundamental element,” believes François Gazier, responsible for asset allocation and fund selection within the Haussmann Patrimoine firm. If you want to recover your short-term capital, you should favor euro funds or money market mutual funds. With a medium or short term horizon, it is possible to further diversify your contract.” Therefore, to benefit from the advantages of the stock market, it is better to have at least eight years ahead of you in order to overcome the different market cycles.

Invest in multiple sectors

It is also important to carefully identify the vehicles available. Account units cover a wide spectrum of investments, from the least risky to the most perilous. They allow you to invest in real estate, bonds, stocks or even investment capital, etc. “Hence the interest in knowing the level of risk of each support, indicates François Gazier. To do this, refer to the SRI (synthetic risk indicator), which places the investment on a scale going from 1 to 7.” Information systematically presented in the key information document (KID) of each fund, a standardized form summarizing the main characteristics of the product.

From then on, you will be able to construct an allocation, namely, distribute your savings across the different categories of financial support. The recipe is subtle because it depends on the degree of risk you accept to take: the more you want to generate long-term performance and agree to tolerate temporary dips, the more you will force the dose on risky assets such as stocks or investment capital. Circular elements may also come into play depending on market dynamics. “It is better to rely on an advisor,” warns Patrick Thiberge. To make it easier for savers wishing to remain independent, certain distributors and insurers provide standard allocations to reproduce or draw inspiration from.

Once this task is accomplished, you will look at the different products. Management companies provide a lot of information on their site. “Immerse yourself in the latest monthly management report and look through the list of the main stocks in the portfolio, which gives a good idea of the color of the fund,” advises François Gazier. Some distributors offer their customers selection assistance tools, providing information on the performance of the media, their rating by the Morningstar or Quantalys analysis platform, the holding of labels, etc. “We have, for example, integrated a “low carbon” indicator, which measures the sustainability rating of the funds,” cites Gregory Guermonprez, director of Fortuneo.

Watch performance history

Past performance is of course an element to be scrutinized closely. “As far as possible, look at the performance history over a long period of at least five years, urges François Gazier. Because these last three years have been so driven by the policies of the Central Banks that the context may have upset the performance of certain managements.” In addition, do not look for a product with double-digit performances every year whatever the economic environment: when the CAC 40 plunges, an equity fund of large French stocks will not be able to work a miracle. “The performance of a fund is studied in relation to that of its competitors in order to target the vehicles which have consistently remained among the best in their category,” indicates Patrick Thiberge.

Another key criterion: management companies. While it is reassuring to favor large houses with a good reputation, do not neglect smaller ones with very specific expertise. We find them, for example, in the area of small and mid-caps. And above all, remember to diversify your portfolio.

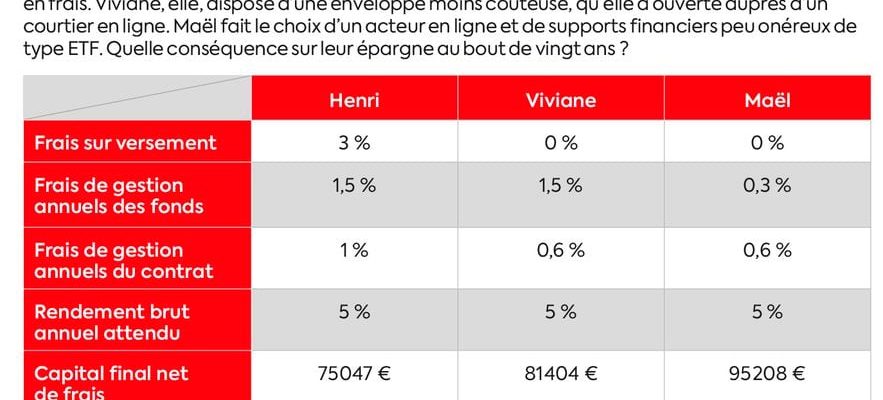

Finally, monitor costs, which hamper your ability to generate long-term performance. “If we accumulate the layers of fees on the units of account, then we might as well make the fund in euros, assures Florent Combes, risk and investment director at Garance. Diversification must provide a real prospect of profit for the client.” In particular, it is necessary to prohibit movement commissions, levied on each transaction within the portfolio, which will also be prohibited from 2026. And be vigilant when the vehicle includes an outperformance commission to check that it does not is not excessive. Long-term work…

NEW3797CT_30 performance absorbed by fees

© / The Express

Regulator focuses on fees

A good point for savers. The supervisory body of insurers, the Prudential Control and Resolution Authority (ACPR), defends the principle of value for money, or, in plain French, the best value for money for a financial product. This notion has led companies to review the list of units of account marketed within their contracts. With one recommendation: check that the cost-performance ratio over five years is good. To help establishments sort things out, the professional association France Insurers had published detailed figures on the performance and costs of these supports. With edifying results since their average annual performance was only 2.09% (from 2017 to 2022). A percentage from which envelope management costs must still be subtracted… Many insurers have already carried out an initial sorting, sometimes substantial. But the ACPR, through its vice-president, Jean-Paul Faugère, recalled on March 6: “This system, which is based on an initial quantitative approach, should not however be seen as an outcome, but rather as the foundation of a continuous approach.”

An article from the special “Placements” section of L’Express, published in the weekly on April 11.

.