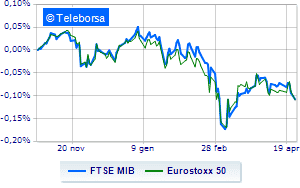

(Finance) – Purchases widespread on European stock listswith the FTSE MIB which scores the same positive performance as the Old Continent. The Eurolistini therefore rebound from yesterday’s significant losses, after the dark and dark session of the Asian stock exchanges and the final rise on Wall Street, although the concerns about global growth due to the harsh anti-Covid restrictions that China is continuing to adopt.

The quarterly in Europewith today’s day marked by those of large banks. UBS reported profit up 17% in the first quarter of 2022, driven by Global Markets. HSBC on the other hand, it saw profits drop for the first three months of the year, due to a decline in revenues and due to write-downs. Banco Santander reported an upward profit in Q1 and confirmed full-year guidance.

Among those who carried out communications in the morningin Piazza Affari trades above par Somec, which has acquired two new orders for a total of 31 million euros in Germany and France. Record good progress Estrimawith the number of Birò ordered in the first quarter of 2022 which grew by 71% compared to the same period of 2021. Also positive Leonardowhose US subsidiary sold its stake in the Advanced Acoustic Concepts (AAC) Joint Venture (JV) to TDSI, a subsidiary of the French company Thales.

L’Euro / US dollar the session continues just below par, with a drop of 0.28%. Slight increase ingold, which rises to $ 1,901.4 per ounce. Light Sweet Crude Oil is sitting in fractional decline, leaving 0.55% on the parterre for now.

On the levels of the eve it spreadwhich remained at +175 basis points, with the yield on the ten-year BTP standing at 2.59%.

Among the main European stock exchanges well set up Frankfurtshowing an increase of 1.19%, sitting without momentum for Londonreflecting a moderate increase of 0.67%, and toned Paris which shows a nice advantage of 0.84%.

Earnings day for the Milan Stock Exchange, with the FTSE MIB, which shows a gain of 0.76%, thus blocking the bearish trail supported by three consecutive declines, which started last Thursday; along the same lines, the FTSE Italia All-Share it makes a small jump forward of 0.69%, reaching 26,352 points.

Slightly positive the FTSE Italia Mid Cap (+ 0.31%); on the same trend, in fractional progress the FTSE Italia Star (+ 0.34%).

Between best performers of Milan, in evidence A2A (+ 2.58%), Interpump (+ 2.24%), Prysmian (+ 2.08%) e BPER (+ 2.03%).

Among the protagonists of the FTSE MidCap, MPS Bank (+ 2.60%), Buzzi Unicem (+ 2.60%), Alerion Clean Power (+ 2.60%) e Anima Holding (+ 2.29%).

The strongest falls, on the other hand, occur on Saint Lawrencewhich continues the session with -2.85%.

Under pressure Mutuionlinewhich shows a decrease of 1.63%.

It slips Sesawith a clear disadvantage of 1.54%.

In red Tod’swhich shows a marked decrease of 1.28%.

Between the data relevant macroeconomics:

Tuesday 26/04/2022

half past one Japan: Unemployment rate (expected 2.7%; previous 2.7%)

14:30 USA: Durable goods orders, monthly (1% expected; previous -2.2%)

15:00 USA: FHFA house price index, monthly (previous 1.6%)

15:00 USA: S&P Case-Shiller, annual (expected 19%; previous 19.1%)

4:00 pm USA: Sale of new houses, monthly (previous -2%).